EURCHF is so far tracking our forecast which assumes a softening in the SNB’s intervention regime and a resultant orderly decline of around one cent per quarter in the cross to 1.03 by year-end. The SNB is certainly not about to abandon the franc entirely to market forces -the excess net private sector demand for CHF stands at 10% of GDP, which would likely cause the franc to appreciate by 5-10% in the absence of countervailing FX intervention.

Nevertheless, there is evidence from the central bank’s rhetoric and action that the SNB is becoming more flexible in its currency policy and that the objective is mutating from the maintenance of a stable bilateral exchange rate versus EUR towards controlling the pace of franc appreciation.

Hence, sell USDCHF through a 3-month put spread. Stay short EURCHF

What has Switzerland to do with US FX policy one may ask? The answer is that Switzerland is the third largest holder of FX reserves globally (6% of global reserves for an economy which accounts for 0.9% of global GDP).

It is also one of only two countries that currently exceed the threshold for FX intervention the US Treasury has established as prima facie evidence of currency manipulation (persistent, one-sided intervention exceeding 2% of GDP). Switzerland is also the sixth largest owner of US Treasuries (rising to fourth if offshore centers are excluded).

In short, Switzerland has a long and enduring history of FX intervention. This may be regarded as a legitimate expression of domestic monetary policy by some observers, but could equally be construed as currency manipulation by others.

The simple point is that the international climate has become less permissive towards large-scale intervention and this is a secondary reason to expect the SNB to progressively taper the amount it intervenes. The primary reason is that there is no compelling economic rationale for the SNB to frustrate all of the CHF appreciation that would be justified by Switzerland’s juggernaut current account surplus.

We stay short EURCHF in cash and add downside in USDCHF through a diagonal debit put spread.

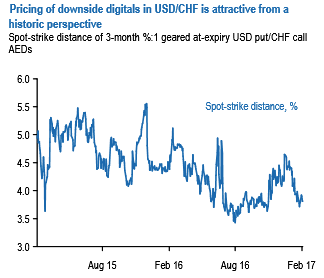

Our choice of a put spread is motivated by: 1) the French election calendar should prevent USD/Europe from running away ahead of the second-round presidential runoff on May 7 and the Assembly elections on June 11 and 18, and 2) digitals are reasonably priced for downside in USDCHF (refer above chart). The digital profile can be replicated with a vanilla spread.

Buy a 1m3m USDCHF debit put spread (with strikes of 1.0225 – 0.9515) (at spot reference 1.0005).

We encourage shorts EURCHF in spot FX as IVs for this pair is conducive for optionality (least IVs among the lot), so, go short for targets up to 1.0525 (almost 100 pips) with a strict stop loss of 1.0755 levels, spot reference: 1.0645 (first entered 1.0720 November 11th).

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise