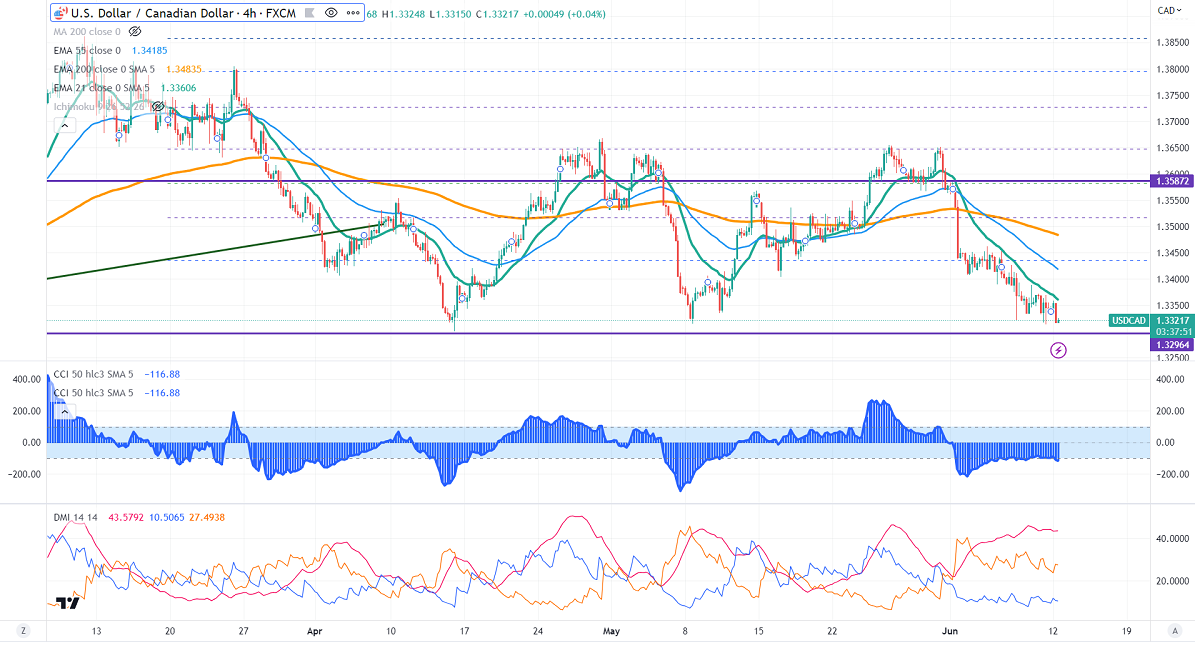

Intraday trend- Bearish

Significant support- 1.3300

USDCAD lost its shine despite weak Canadian jobs data. The Canadian economy lost 17400 jobs in May, below the estimate of 21200 jobs. The unemployment rate rose to 5.2%compared to a forecast of 5.1%. It hits a low of 1.33164 yesterday and is currently trading around 1.33214.

Technically in the 4-hour chart, the pair is holding below short-term (21- and 55 EMA) and 200 EMA (1.36301). Any break below 1.3300 will take the pair to 1.3220/1.3200.

The near-term resistance is around 1.337 and any breach above targets is 1.3400/1.3435/1.3500.

Indicators (4 Hour chart)

CCI (50)- Bearish

ADX- bearish

It is good to sell on rallies around 1.3350 with SL around 1.3400 for a TP of 1.3220.