Intraday bias - Bullish

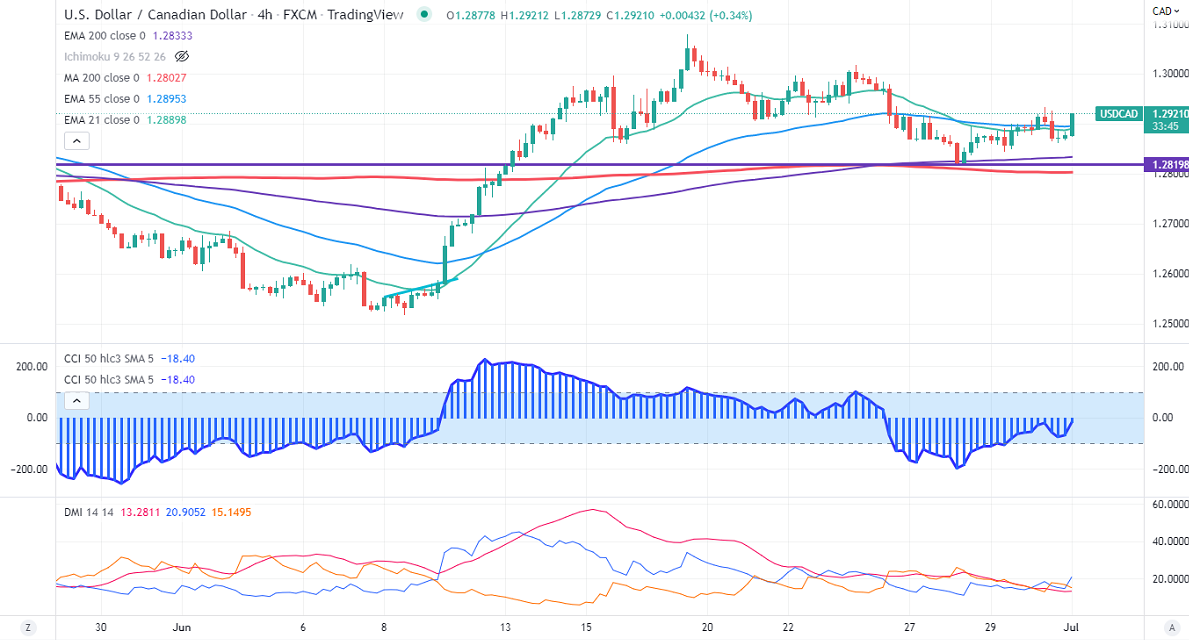

USDCAD regained above 1.29000 after Canadian GPD data. It grew 0.3% in Apr, while an early estimate for May shows a decline of 0.2%. US dollar index pared some of its gains after downbeat personal spending and weak PCE. Markets eye the US ISM manufacturing index for further direction. The minor sell-off in oil prices also pushes the pair further higher. Technically in the 4 -Hour chart, the pair is holding above the short-term (55 EMA, and 21- EMA), and the long-term moving average of 200 EMA (1.28324). Any violation above 1.2860 confirms a bearish continuation. A dip to 1.2820/1.2778/1.2700 is possible. USDCAD hits an intraday high of 1.29199 and is currently trading around 1.29166.

The near-term resistance is around 1.2935, any breach above targets 1.2965/1.3000/ 1.3080.

Indicators (4 Hour chart)

CCI (50)- Bearish

ADX- Neutral

It is good to buy on dips around 1.2880 with SL around 1.2820 for TP of 1.3000.