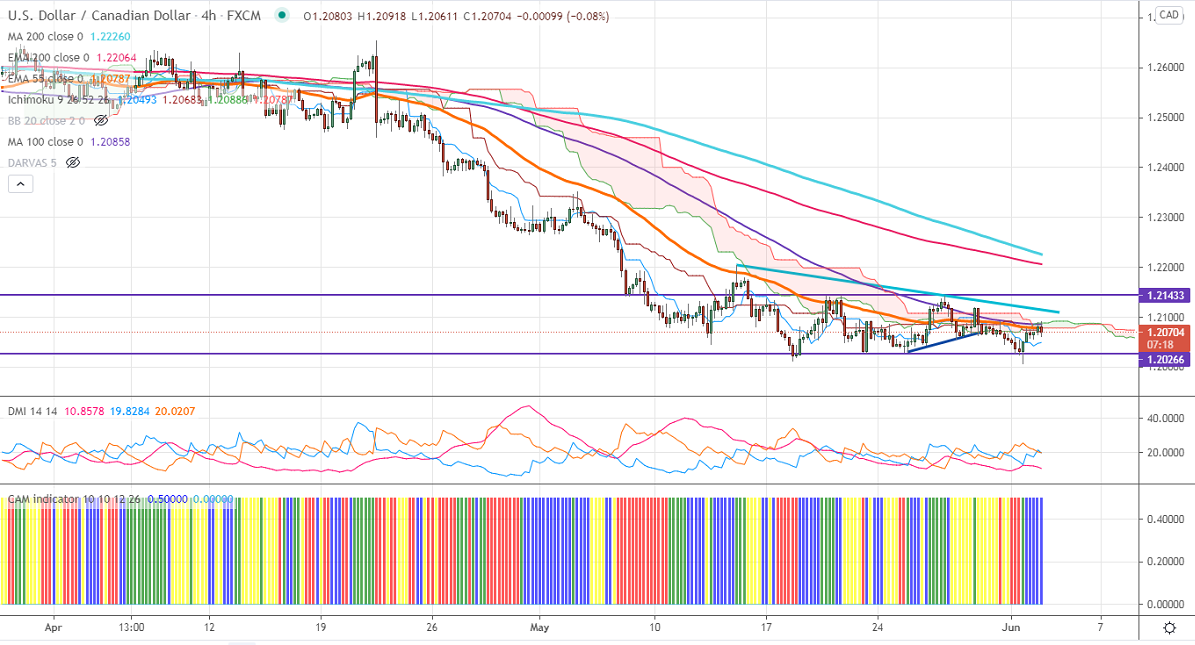

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.20479

Kijun-Sen- 1.20744

Major intraday resistance -1.20920

USDCAD declined slightly after a minor pullback till 1.20919. The overall trend is still bearish as long as resistance 1.21500 holds. The surge in global commodity prices is supporting the Canadian dollar. USDCAD is trading for the past year and has lost more than 15%. Loonie hits an intraday low of 1.20563 and is currently trading around 1.20688.

WTI crude oil is hovering near two year high after OPEC agreed to ease supply cuts through July. The short-term trend is bullish as long as support $61.50 holds.

Technically, the pair faces near-term resistance at 1.20925. Any indicative break above will take till 1.2150. Minor trend continuation only above 1.2205. The significant support is around 1.2000. Any violation below will take to the next level to 1.1970/1.1950.

Indicator (4-hour chart)

CAM indicator – Slightly Bullish

Directional movement index –Neutral

It is good to buy on dips around 1.2050 with SL around 1.2000 for a TP of 1.2150.