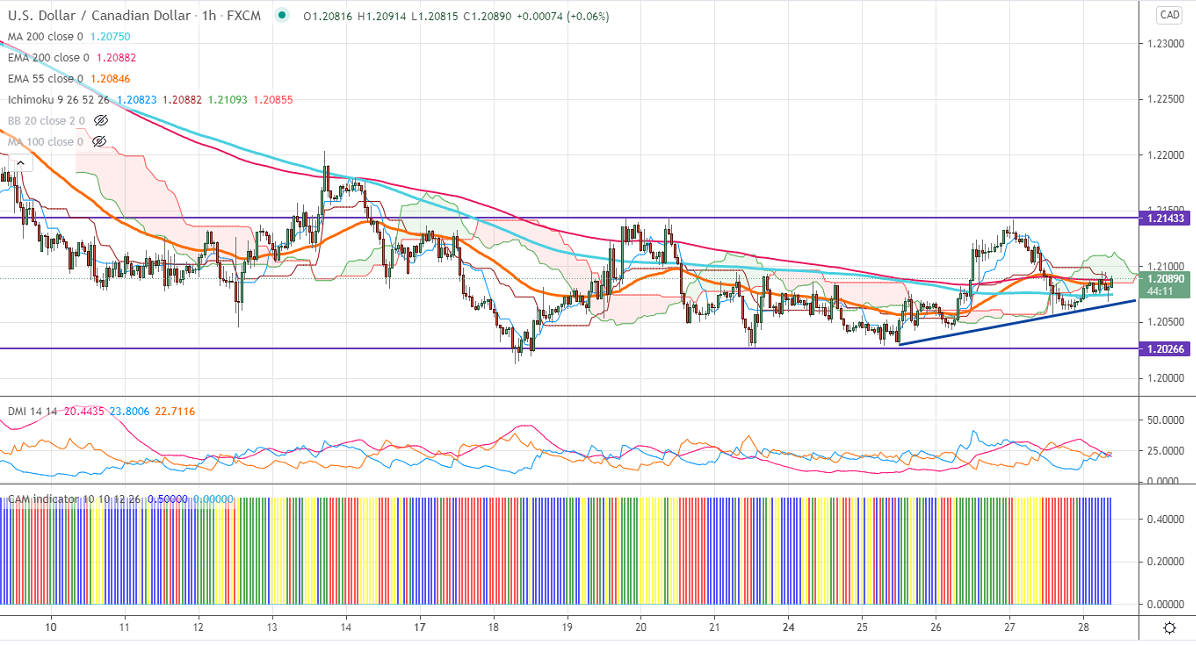

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.20823

Kijun-Sen- 1.20882

USDCAD is consolidating in a narrow range for the past four days. The pair should break above 1.20950 for further bullishness. The pair hits a 6-year low on surging commodity prices. Markets eye US PCE data for further direction. The easing of lockdown in major countries and opening of the global economy will support commodities such as oil. It hits an intraday low of 1.20692 and is currently trading around 1.20913.

WTI crude oil is holding above significant resistance $67. A jump to a fresh year high of $67.94 is possible The short-term trend is bullish as long as support $61.50 holds.

Technically, the pair faces near-term resistance at 1.2150. Any indicative break above will take till 1.21850/1.22031 (May 13th high). Minor trend continuation only above 1.2205. The significant support is around 1.2040. Any violation below will take to the next level to 1.2000/1.1970/1.1950.

Indicator (1-hour chart)

CAM indicator – Neutral

D4irectional movement index –Slightly bullish

It is good to buy on dips around 1.2080 with SL around 1.2040 for a TP of 1.2180.