We’ve seen bullish swings in recent our post on technical analysis, although USDZAR has been spiking in the recent past from the lows of 13.2492 to the current 13.6061 levels, whereas the major bear trend of this pair is still intact, please go through the below weblink for more reading on technicals of this pair:

Capitalizing on momentary rallies of this pair one can load up shorts in ITM puts in a credit put spread with a narrowed strikes and tenors.

While major downtrend could be arrested by the longs of the underlying pair with longer tenors as you’ve seen the selling momentum is intensified by leading oscillators with mammoth volumes on long-term technical charts.

So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

As we expect the retest of multi-months lows of 13.1987 or below in the weeks to come amid any abrupt upswings.

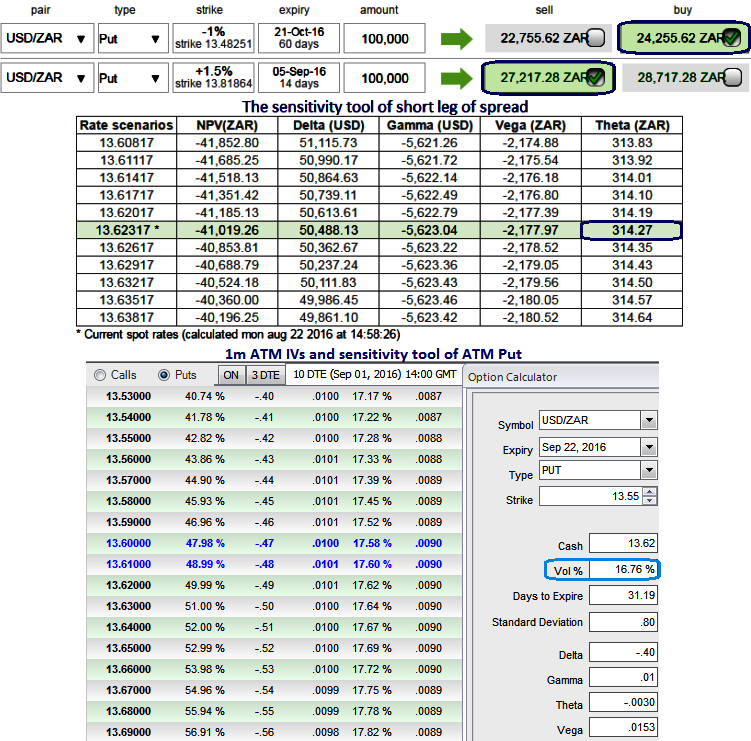

For the ease of understanding, we’ve just considered this option strategy with shorts in 1W (1%) ITM put with positive theta or closer to zero while buying 1M (0.5%) OTM put option; the strategy could be executed at the net credit.

For an instance, as we know theta measures time decay in your options premium value per day which would mean as shown in the diagram the premiums on short leg today is worth 28,717.28 and theta is 314.27 then over every time break, all else been equal, the option premium should be waning out to 28,403.01. This would be the case even when underlying spot never goes up but remains in sideways.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases.

Well, in above case of diagonal credit put spreads, the strategy could be constructed at the net credit, the short leg would be absolutely at profits when underlying spot remains either at strikes chosen or at higher than strikes on the expiration of short side.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise