Since the BoJ succeeded in killing yen volatility, USDJPY has been a proxy of dollar rates. Japanese long-term rates are following US rates, but have shown almost zero volatility for a year now (refer above graph). USDJPY is thus coincidentally positively correlated with JPY rates.

USDJPY is projected to slide towards 100 if:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options trades recommendations:

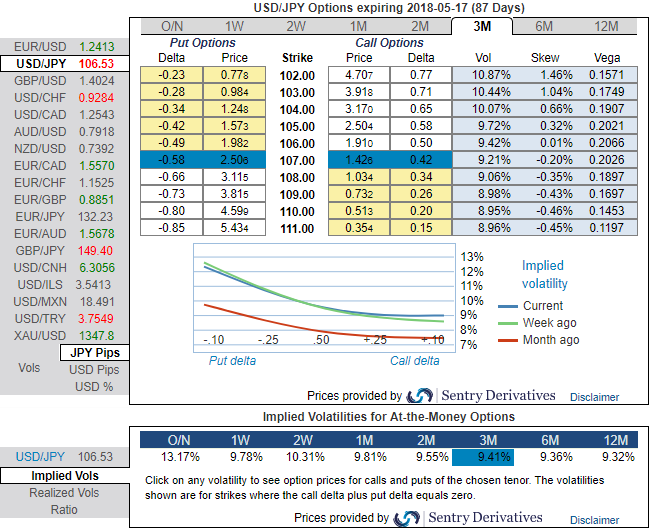

The implied volatility of ATM contracts of USDJPY is shrinking away, trending at around 9.81-9.41% for 1-3m tenors, as the delta risk reversals flashing up progressively with negative numbers in 3m tenors that signifies the hedging sentiments for downside risks over the period of time, this appears to be conducive for put option holders. Positively skewed IVs of 3m tenors are also of the same indication.

Thus, we advocate buying USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 106.519).

Investors trading a put spread with a global knock-in cannot lose more than the premium initially paid. However, the structure will be activated only if USDJPY hits the 116 knock-in. Otherwise, it will expire worthless even if USDJPY trades below 106 one year ahead.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -81 (which is bearish), while hourly JPY spot index was at 2 (neutral) while articulating at 07:02 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges