As witnessed on many occasions previously, a sharp sell-off in global equity markets helped to bolster the Japanese yen, with USD/JPY briefly spiralling below 116.10 on 24 August, from above 124 only the week before.

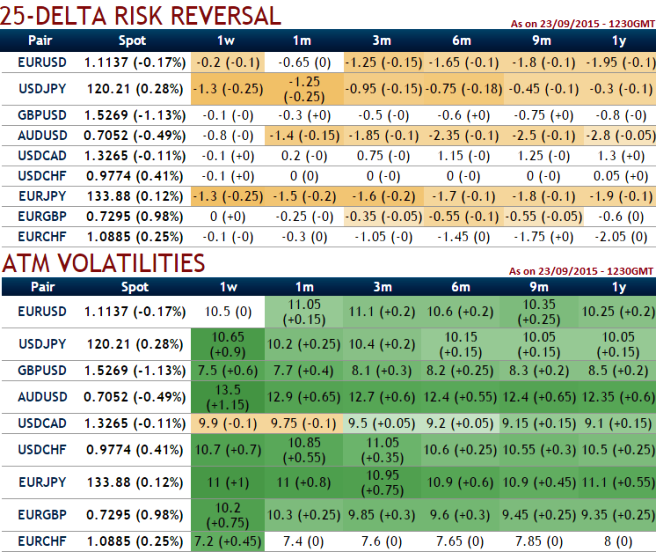

The pair is likely to perceive higher implied volatility close to 10.65% of 1W ATM contracts (highest amongst the lot), the most noticeable point is delta risk reversal of ATM contracts of 1 week expiries is edging up in negative values, this would signal us that bearish sentiments are intensifying in short term.

From the above table, we can observe that 1 week contacts have reduced implied volatilities after the much awaited last week's fed's meet which did not evidence any change in its rate policy, delta risk reversal for USDJPY is still highest negative values among entire G7 currency pool, this would mean that market sentiments for this pair have been bearish for this pair.

External developments and market volatility represent the key drivers for the yen in the near term, with China and the timing of the first rate hike in the US considered the two main influences.

Meanwhile, the domestic economic situation remains disappointing, supporting the case for continuing massive monetary stimulus to combat entrenched deflationary pressures. The economy contracted by 0.3% in Q2, leaving open the prospect of the BoJ adding to its easing measures, possibly as soon as next month. This will keep fundamental downward pressure on the yen, particularly against currencies where monetary tightening is soon expected.

FxWirePro: USD/JPY delta risk reversal of shorter maturities signals costlier bearish hedging

Thursday, September 24, 2015 10:51 AM UTC

Editor's Picks

- Market Data

Most Popular