The short-term implied valuations of USDJPY point to further downside bias, but the floor at 108.40/50 remains firm. Expect more downside momentum to build if that level is breached, but note a lack of drivers for the pair to probe significantly lower, unless the Sino-US headlines turn south.

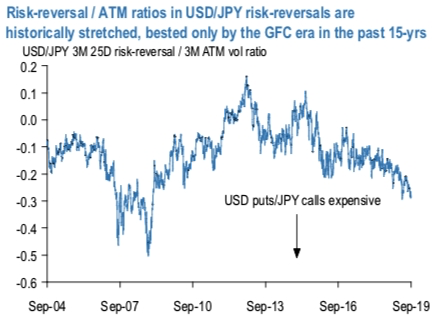

While we reiterate the fact from our previous post that the risk-reversal numbers of the pair have been persistently bid through the back half of last year and most of this, so much so that RR/ATM ratios have now reached levels reminiscent of GFC era extremes (in favor of JPY calls, refer 1st exhibit) despite nominal pricing of Yen options being orders-of- magnitude more benign today.

While the fresh negative risk reversal numbers of short tenors show some renewed sentiments for the weakness ahead of Fed’s monetary policy that is scheduled for this week amid the broad-based hedging sentiments for the bearish risks remain intact across all tenors (3rd exhibit).

It may be tempting to associate this apparent “distortion” with the risk-bearishness – and attendant hedging demand for Yen calls – brought about by the long-simmering US/China trade conflict. The reality is far more mundane however, and rooted in the currency hedging preferences of Japanese institutions and corporates as the Fed – BoJ policy rate gap widened over the past 12-18 months. Instead of incurring the steep negative carry of selling USDJPY forwards (to the tune of 250-300bp) to cover FX risks of USD receivables /US bond exposures, Yen buying flows have increasingly taken the form purchasing USD puts/JPY calls on risk-reversals that were judged to be relatively inexpensive vis-a-vis forwards.

Please be noted that the USDJPY positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 104.50 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand (refer 2nd exhibit).

Hence, at spot reference of USDJPY: 107.996 levels, we advocated buying a 2M/2w 109.732/105.50 put spread ahead of monetary policy season that is scheduled for this week (vols 5.55 vs 5.15 choice), the strategy has been functioning as predicted.

Hence, currently the underlying spot is trading at 108.572 (while articulating) we wish to uphold the two-legged strategy comprised of both ITM and OTM puts, wherein short leg is likely to get favoured in low IV environment and function even if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Courtesy: JPM, Sentry & Saxo

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks