While Christmas is fast approaching, this week is still a busy one for both policymakers and financial markets. Fed is scheduled to announce its funds rates on 13th Dec that is most likely to hike by 25 bps and ECB to announce its monetary policy on 14th, and later in the week, the EU summit is expected to confirm that ‘sufficient progress’ has been made to push Brexit talks forward to the next stage.

As the ECB edges towards normalization, an undervalued euro has room to rise further, the European central bank joined in and a significant dollar rally was underway.

The FX market reaction to the US labor market report on Friday was an ideal illustration of how the market operates at present. Just as a reminder: the number of new jobs created in November (which used to be the most important data release on any FX traders monthly data calendar) came in well above the expectations of the large majority of analysts at 228k (media of expectations 195k). That means the real economic data would have justified USD appreciation, but in fact, the market’s initial reaction was: USD weakness.

Hence, in this seesaw sentiments, options straddles deploying +0.51 delta ATM call and -0.49 ATM delta puts at net debit. The strategy is likely to hedge underlying spot FX price risks in the below OTC sentiments regardless of the above stated driving forces.

The current slope is at shy above 7.25% which is below prior peaks whereas historical vols are near 6.9%, our intent is to begin legging into EUR 1Y ATMs perhaps 0.3-0.5 vols lower from the current market once we see a 2-handle print on the curve.

Given the depth of the Euro option market, owning EUR vol from near two-decade lows constitutes the most scalable FX risk premium normalization trade for 2018 in our view.

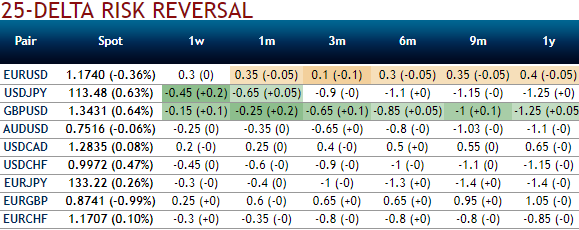

While please be noted that the recent shift in risk reversals are flashing negative number. However, the hedging interests for bullish risks remain intact. This standpoint is substantiated by positively skewed IVs of 1m tenors.

Hence, alternatively, those who are dubious about euro’s bullishness, the 3m EURUSD call spread of net delta around 0.39 is advocated at net debit.

Contemplating above OTC market reasoning and fundamental factors we think further upside risks are on the cards amid minor hic-ups, as a result we reckon deploying longs on ITM call option with delta being at around +0.61 in hedging strategies are worthwhile and to reduce the cost of hedging we would also like to write over OTM puts as the northward forecasts remain maximum upto 1.21 mark.

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction displaying shy above 27 levels (bullish), while hourly USD spot index was at 26 (bullish) while articulating (at 12:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal