In U.K. this week's purchase managers index in all trajectories (manufacturing, construction and service) have been highly disappointing to miss forecasts.

- Manufacturing PMIs dropped vigorously from previous 52.9 to 50.8 against forecasts at 52.3.

- Construction PMIs reduced from previous 55.0 to 54.2 against forecasts at 55.5.

- A steep in dip in Service PMIs to miss the forecasts have disappointed GBP's gains, reduced from previous 55.6 to 52.7 against forecasts at 55.1.

These leading economic indicators divulge economic health and how the businesses adopts quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

Whereas, BoE has recently stood pat at the benchmark UK interest rate at 0.5% in last month's monetary policy. This unchanged rate was no surprise to the forecasts. BoE's QE in Jan total GBP stays flat at 375 bln GBP vs previous 375 bln GBP.

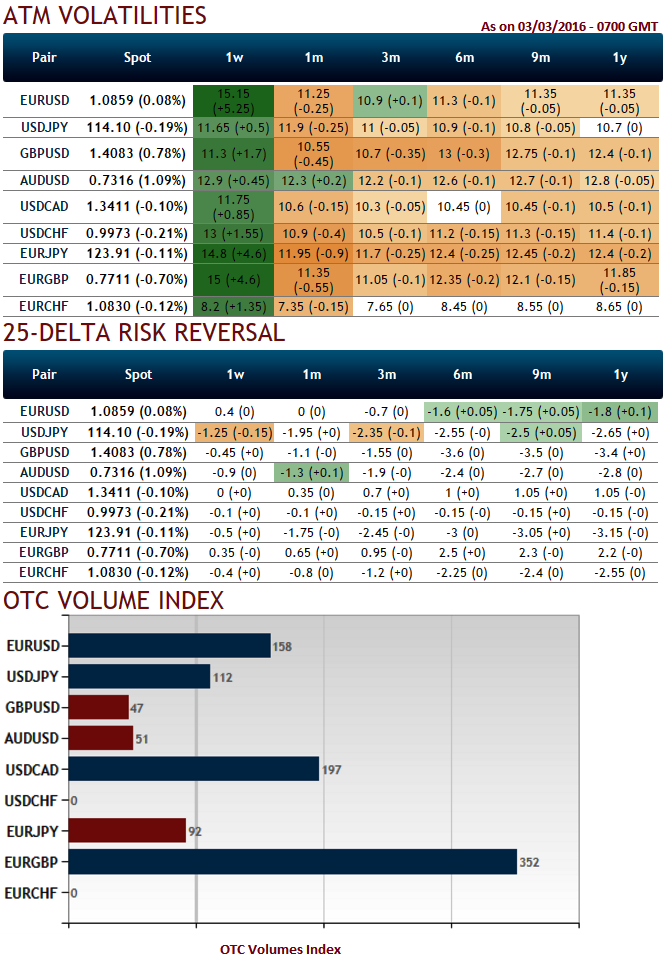

Elsewhere, please be mindful of OTC order flow analysis:

The implied volatility of ATM contracts for near month expiries of this the pair are spiking sky rocketed at around 15% which is second highest among G10 currency space.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks over the period of time.

While current IVs of ATM contracts are at higher levels but likely to perceive hover around at an average 12.28% in long run that would divulge pair's gain contemplating risk reversal arrangements.

Hence, considering OTC market reasoning we think upside risks are on the cards, as result we reckon deploying ATM instruments in hedging strategies are worthwhile.

The spot FX of EURGBP is trading at 0.7732, and is anticipated to spike up moderately in the weeks to come.

1W ATM calls are trading just 11% shy above NPV, while IVs are at 15%.

We decide to initiate a bull option combinations at net credits capitalizing on IVs, RR and underpriced ATM calls,

So, buy near month at the money calls with 50% delta, simultaneously, short 1W (-1%) in the money put with positive theta.