Crude oil-

WTI crude oil showed a minor bounce after Saudi Arabia hiked prices to Asia. It hit a low of $77.95 yesterday and is currently trading at $78.92.

Saudi Arabia gained Aramco hiked selling price of crude oil price by 90 cents to $2.90. The renewed tension in Gaza also supports prices at lower levels.

US economic data

US Nonfarm payroll- Weak (negative for crude)

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude.

Major resistance - 106.50/107.20.

Major support- 105/103.80.

Geopolitical tension- Progress in ceasefire talks between Israel and Gaza stalled (positive for crude).

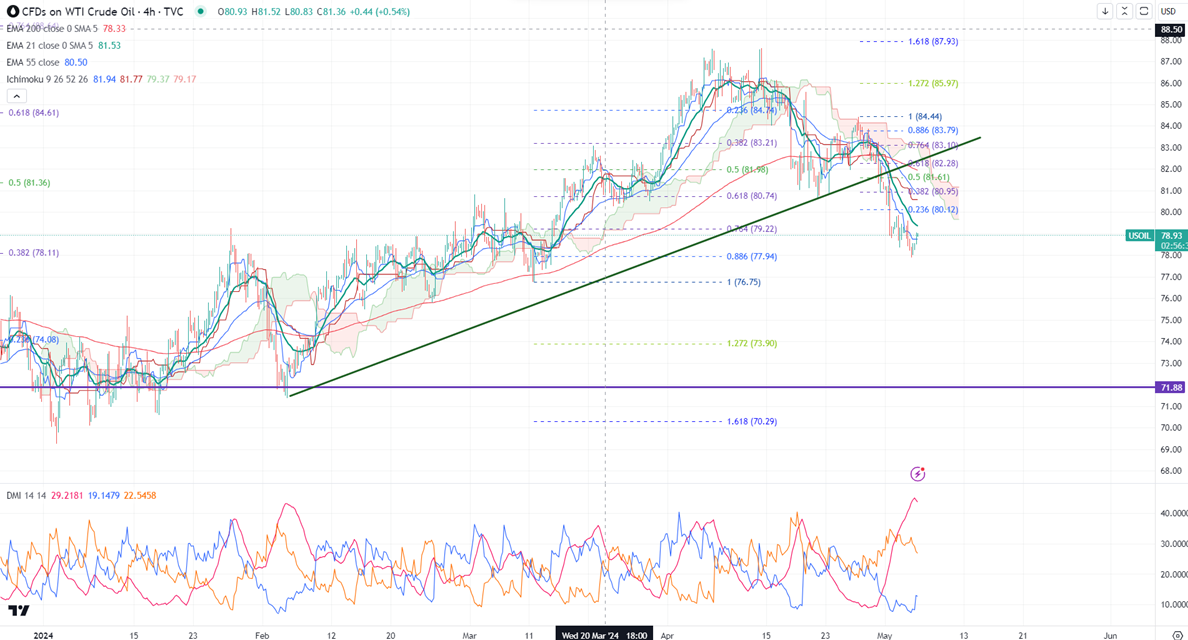

Ichimoku analysis (4- hour chart)

Tenken-Sen- $78.74

Kijun-Sen- $80.58

The immediate resistance is around $80. Any jump above the target of $80.55/$81.20/$82/$82.53/$83. On the lower side, near-term support is around $77.90. Any breach below will drag the commodity down to $76/$75.

It is good to sell on rallies around $80 with SL around $83.10 for a TP of $80/$78.