The industrial production in the UK dropped by 1.3% MoM in October, dramatically undershooting our and consensus expectations, building on a 0.4% MoM contraction in September. Within overall production, manufacturing output also dropped by 0.9% MoM, more than reversing a 0.6% MoM gain in September.

It was the sharpest decline since September 2012, as mining and quarrying fell sharply, dragged by oil and gas extraction; and manufacturing output also shrank, mainly due to a contraction in pharmaceuticals. Furthermore, sterling’s export-supportive declines notwithstanding, an export-led boost and rebalancing away from services and the consumer still seems relatively distant on these data.

Just until recent times, the many analysts had been expecting the RBA to sit tight at 1.5% cash rate for some time and the central bank also delivered as anticipated.

But in contrast, the Australian economy unexpectedly declined 0.5 pct in the Q3’2016, compared to an upwardly revised 0.6 pct growth in the June quarter and missing market consensus of a 0.3 pct expansion.

As a result, the RBA’s monetary policy would remain expansionary; a more easing cycle is on cards. In other words, the Aussie central bank members can make the most of the summer break, rate hikes in Australia are not foreseeable for now which would imply that the more bearish pressures on AUD.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

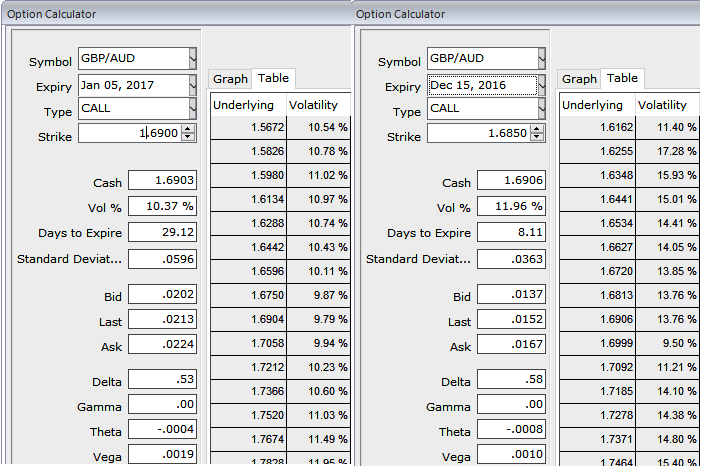

Rationale: The current implied volatility of GBPAUD 1w ATM contracts is just shy below 12%, and it is likely to shrink below 10.5% for 1m tenors as shown in the IV nutshell, shrinking IVs is conducive for over-priced option writers. Option writers of expensive calls with 1m expiries would be on competitive advantage.

The execution of the strategy: Go long in GBPAUD 3M at the money -0.49 delta put, long 3M at the money +0.52 delta call and simultaneously, Short 1m (1.5%) out of the money call with positive theta or closer to zero.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures