First, the direction of GBP de-leveraging (pound strength) is against the grain of risk-reversals i.e. in the direction of lower, not higher vol on the skew. There is a case to be made then that unlike short expiries that respond to immediate spot developments, longer-tenor (6M –1Y) vols should remain much better behaved and probably even head lower once the dust settles.

History strongly argues in favor of such muted vega response: The above table shows that 5%-10% quarterly spot moves in GBP keep 1Y ATMs more or less unchanged on average, with a sharp skew towards vol weakness rather than strength. Larger than 10% spot rallies almost always lead to material vol compression, but the inference could be distorted by the post-GFC experience of a V-shaped sterling rebound and inverse V-shaped vol collapse following the introduction of US QE which is not an appropriate lens to view the current episode.

Second, Abenomics may be a flawed template to use for gauging GBP vol behavior in the current instance due to the absence of structured product effects on the same scale as in yen: recall that spot-vol correlation in USDJPY had turned sharply higher (positive) during the 2012-13 period due to a flip in the dVega/dSpot profile of FX option books, as the traditional PRDC-driven inverse spot-vol link was upended by Japanese importer structures seeking to take advantage of yen weakness.

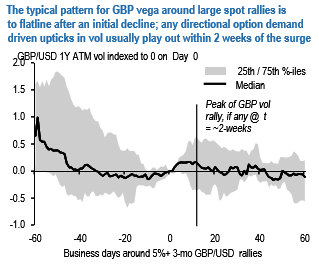

The resulting vega hedging demand as spot climbed is unlikely to be replicated in a GBP context where structured option flows are thinner. Our bias is to not stand in the way of the first flush of any GBPcall buying over the next few weeks, but to fade any eventual rally by selling 9M –1Y vol along upward sloping vol curves across the GBP complex. From a tactical timing standpoint, the pattern of 1Y ATM behavior around large GBP rallies suggests that vols do not locally top out till about 2-weeks into the spot spike (refer above chart), hence we are content to bide our time in the hope of higher back-end vols to sell in coming weeks.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate