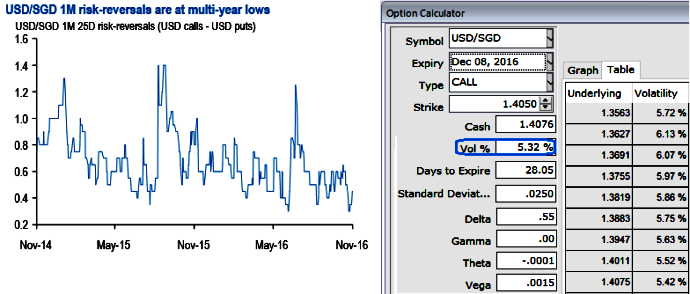

USDSGD 1M 25D risk-reversals: USDSGD 1M 25D risk-reversals are at multi-year lows (see chart), around levels that prevailed ahead of the Brexit vote in June.

The spot-vol correlations should remain high and positive in USD/EM pairs irrespective of the outcome of the elections (i.e. spot and vols both higher if Trump wins, which does not seem to be factored into current depressed skew levels, hence risk-reversals should act as convex hedges from here.

We are however acutely aware that –

a) SGD NEER is at -55bp within the band, as opposed to +150 bp earlier this spring i.e. the strong asymmetric bias of SGD to weaken within the band has diminished; and

b) The crowded SGD shorts are quite visible, which can have the effect of dampening the volatility of the currency to an event shock next week (see tepid IVs of ATM contracts).

In other words, there are factors at play that can mitigate spot-vol correlation in this instance; hence instead of a pure vol construct (i.e. delta-hedged), it is preferable to run with a live (i.e. delta-unhedged) risk-reversal as a directionally bullish dollar play that can benefit from generalized Asian FX stress stemming from a Trump victory.

Moreover, the medium-term balance of risks for USDSGD has shifted to the upside as the advance quarterly GDP prints of the US has increased recently, while the GDP in Singapore has been contracted 4.10 pct in the Q3’2016 over the previous quarter.

Observing market pricing Fed hikes in December, while the benchmark interest rate in Singapore was last recorded at 0.38 pct and other underlying factors, we foresee further upside risks upto 1.4080 and 1.4240 cannot be disregarded.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?