A Glance at Fundamentals: Aussie dollar is losing its buying momentum as RBA is scheduled for its monetary policy, we expect the cash rate announcement to be on hold. However, our view of two RBA rate cuts in H2 obviously hurts the Aussie but data isn’t likely to stoke much more pricing of rate cut risk before August.

Meanwhile, Australia’s key export prices have bounced, and US-China trade talks seem likely to result in some form of deal. The Australian economy grew a seasonally adjusted 0.3 percent in the September quarter of 2018, slowing sharply from a 0.9 percent expansion in the previous period and missing market consensus of a 0.6 percent advance.

Technical Glance: EURAUD slumps below 7 & 21-DMAs on a back-to-back shooting star and spinning top patterns at stiff resistances of 1.6066 levels (to be precise at 1.6059 and 1.6058 levels respectively, refer 2H chart).

On a broader perspective, back-to-back shooting stars pop-up at peaks coupled with the overbought signal by leading oscillators, while major trend goes in range but slightly bearish bias (refer monthly chart).

Overall, amid interim rallies, the major trend is now stuck in a range with lingering bearish biasness. Hence, upswing seems unlikely to prolong as both leading and lagging indicators are not in conformity to the prevailing bullish rallies (refer monthly chart).

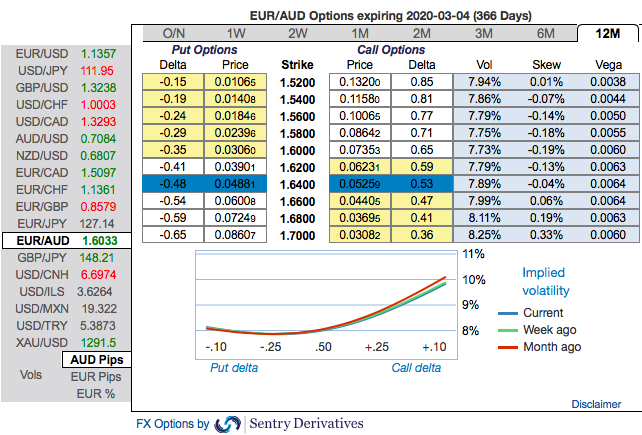

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 1Y tenors are signifying more hedging interests in both bullish and bearish risks. The bids for OTM calls of this tenor indicate that the underlying spot FX likely to spike up to 1.70 levels and bids for OTM puts show 1.52 levels.

Contemplating fundamental, technical and OTC factors, as shown above, it is sensed that all chances of Euro may look superior over the Aussie dollar in the near term and vice versa in the medium-term future; accordingly, we advise to hedge the puzzling swings through below options recommendations.

The execution: Buy 2 lots of at the money -0.49 delta put option of 3m tenor and simultaneously, buy at the money call option of 1m expiries. The option strip is more of customized version combination and more bearish version of the common straddle.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to slide downside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -53 (bearish), while AUD is flashing at -63 (bearish) while articulating at 08:04 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices