The foreign ministers from Europe’s six founding members called for the UK to provide clarity as soon as possible. The founders also recognized the different levels of ambitions among the member states as it stated.

While not stepping back from what we have achieved, we have to find better ways of dealing with these different levels of ambition so as to ensure that Europe delivers better on the expectations of all European citizens.

Looking ahead, the Draghi’s speech on monetary policy minutes would more interesting especially after the shocking results of Brexit votes.

Because the volatility is often experienced during his speeches as traders attempt to decipher interest rate clues.

He had mentioned in his last speech that the economic recovery to proceed at a moderate but steady pace. Nevertheless, for this recovery to be consolidated, our efforts should now concentrate on strong policy action to improve the business environment, favor investment and raise productivity. Delivering on these objectives will not only create the conditions for inflation to accelerate its return to levels below but close to, 2%.

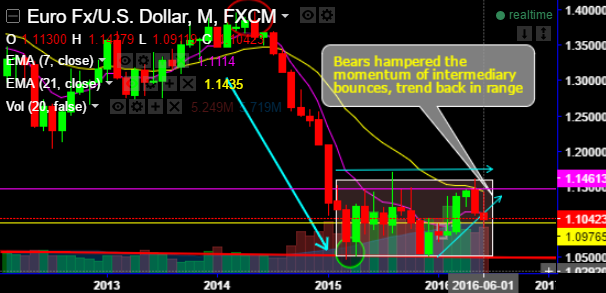

Not only should the risk premium in the FX market fall, but the environment will not support the emergence of new trends. In particular, as you can probably observe from EUR/USD technical charts, the trend has been confined within the large 1.05-1.16 range holding since March 2015, we expect the range to persist going forward but slightly bearish biased.

Volatility peaked during the euro fall that began in 2014, but though the range was relatively turbulent initially, EUR/USD realized volatility is now going down. The market can’t keep buying volatility in a trendless market and with limited central banks shifts expected in the coming months.

So shorting strangles are luring avenues of FX pairs using OTM strikes using 3mtenors are likely to fetch the certain yields.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge