The long-awaited October EU summit is now less than a week away and optimism that the UK and EU can secure a withdrawal agreement has continued to build since the end of the UK political conference season. The sense that the end-game to the two-year Brexit saga is nearing has lifted GBP by 1.5% from last couple of days.

With just five and a half months before the planned Brexit date of 30 March 2019 and an agreement providing for the UK’s orderly exit from the European Union (EU) yet to be reached, EU/UK official talks on a withdrawal agreement in accordance with Article 50 of the EU Treaty, have gained pace. Not long ago, EU Brexit Commissioner Michel Barnier stated that it is “realistic” to expect a withdrawal agreement (i.e. a deal on the first phase of Brexit negotiations) by mid-November.

Admittedly, out of the five priority issues necessary for a withdrawal agreement, three have already been settled: EU citizens’ rights, UK financial commitments and the 21-month status quo transition period after the UK’s exit to allow time for consumers, businesses and public bodies to adjust to changes in the rules governing their operation as a result of leaving the EU.

While the UK confidence has fallen again, with the Lloyds Business Barometer dropping to 19 from 29, and GfK consumer confidence slipping to -10 from -9, likely due to Brexit uncertainty.

OTC outlook:

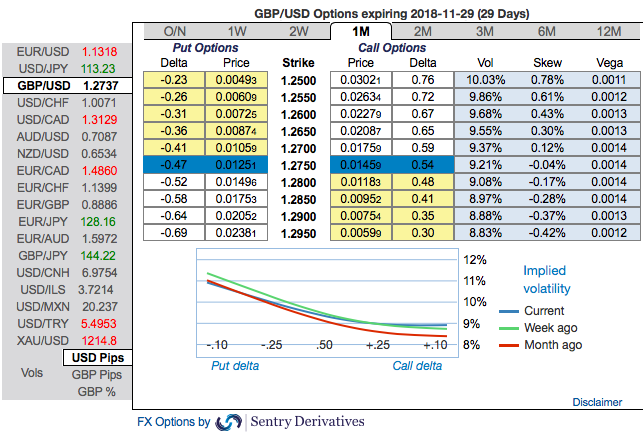

Positively skewed implied volatilities still signal bearish hedging sentiments. Although minor positive shifts are noticed in risk reversals, bearish risk sentiment remains intact. While it is observed that GBPUSD shows highest number of OTC volumes ahead of BoE’s monetary policy.

We reckon that the sterling should not suffer like before, but, one should not disregard Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by delta longs.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -29 levels (which is mildly bearish), and hourly USD spot index has bearish index is creeping at 111 (bullish) while articulating (at 13:24 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges