We continue to envisage a phased decline in EURCHF to 1.03 by year-end predicated on a relaxation in the SNB’s very aggressive intervention tactics once the immediate threat of exchange rate instability spilling over from the French election has passed.

We do not expect a benign outcome to that vote to sponsor an underlying weakening in the franc since the upward pressure on CHF clearly predated the emergence of political stress in the Euro area and is caused instead by Switzerland’s positive balance of payments position.

The basics of that situation remain intact –an inadequate interest rate differential between CHF and EUR to generate sufficient private-sector capital outflows to recycle the large current account surplus. The current a/c surplus was 10.8% of GDP in 2016, in contrast to which unhedged private capital outflows were less than 1.5% of GDP.

Our longstanding bullish view on CHF has been motivated by the decent domestic data both on the activity and inflation front which should eventually result in reduced FX intervention activity by the SNB.

The past week reinforces the view that activity data remains strong in Switzerland with the KOF leading indicators beating consensus to make a new 3-year high.

The SNB has admittedly continued to intervene in FX markets — it sold CHF 2.9bn last week even though EURCHF was above 1.07 — perhaps indicating a more active approach to engineer a squeeze in the cross.

However, interventions are likely to become increasingly given the global political climate.

The Treasury is due to release its semiannual report on currencies on April 14th and Switzerland is again expected to meet the thresholds for two out of the three criteria that the Treasury uses to identify currency manipulators.

Stay short EURCHF in cash (first entered 1.0720 since March). Marked at 0.3%.

The primary reason is that there is no compelling economic rationale for the SNB to frustrate all of the CHF appreciation that would be justified by Switzerland’s juggernaut current account surplus. We stay short EURCHF in cash and add downside in USDCHF through a 3-month put spread.

Since we sold, 3m vols have dropped by 1.7 points and the 3-mo risk reversal has tightened from -3.4% to-2.5%.

Hold a 2m 1.0050 - 0.97 USDCHF put spread.

Our choice of a put spread is motivated by:

1) The French election calendar should prevent USD/Europe from running away ahead of the second-round presidential runoff on May 7 and the Assembly elections on June 11 and 18, and

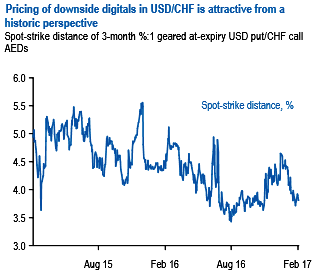

2) Digitals are reasonably priced for downside in USDCHF. The digital profile can be replicated with a vanilla spread (refer above chart).

3) We would like to favor optionality in USDCHF as ATM IVs are comparatively better over EURCHF.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated