Probably the strongest argument for remaining short EURCHF is the empirical observation that the cross has bounced barely 0.5% off its five years lows despite the fact that equities have retraced 55% of their peak losses. This failure of CHF to weaken alongside the surge in equities demonstrates a point we have laboured ad- nauseam – CHF doubtless functions as a safe-haven when growth and risk markets crash, but it’s also supported by exceptionally powerful forces (a chronic BoP disequilibrium) that enable it to hold onto those gains whenever global conditions improve. CHF is a highly asymmetric safe-haven, which of course is just another of saying that CHF is in an uptrend. Risk markets can’t reverse the uptrend when they rally, they sure do accentuate the bullish trend whenever the risk climate turns sour.

As described in the overview we believe CHF is well positioned as investors turn their attention to second- round consequences of COVID-19 for central bank policy in an era of ballooning public deficits. The Swiss Confederation is in better financial shape than virtually all other major countries (Norway is a clear exception) and it's in part because of this (and the strong current account position), that CHF has the second lowest QE vulnerability ranking in our sample.

This is not to say that the SNB is not expanding its balance sheet, just that the imperative to expand to finance deficits in excess of 10% of GDP is nowhere near as acute as elsewhere. The SNB does continue to grow its balance sheet through foreign QE of course. Of interest today was the SNB’s balance sheet for March. This would suggest that the bulk of the increase in sight deposits through March was indeed due to FX intervention and not the start of the SNB’s COVID-19 refinancing facility. Usage of that facility looks to have been only CHF 1.1bn whereas total sight deposits adjusted for the increase in cash in circulation increased by CHF 27.5bn. Obviously there is no clarity yet on how much of the subsequent CHF 30.2bn increase in sight deposits through April was due to intervention.

Trade recommendation: Stay short in spot EURCHF from 1.1030 levels.

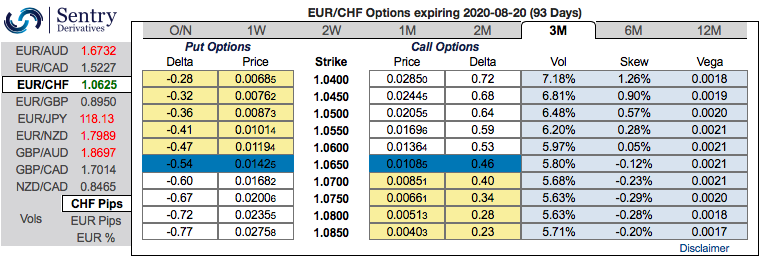

Bidding 3m positively skewed IVs and risk reversals that are indicating brief upside and downside risks in the major downtrend continuation, we advocate diagonal debit put spread strategy comprising of both short and longs in optionality with shorter tenor on short leg and longer tenor on long leg.

The execution: Capitalizing on the prevailing minor upswings in the short-run, stay short in 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or continues prevailing rallies mildly), simultaneously, add long in delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, on hedging grounds, stay short in EURCHF futures contracts of mid-month tenors ahead of eurozone PMI data announcement, spot reference: 1.0623 levels (while articulating). Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025