Sell a put against existing cash short in EURSEK. Stay short NZDSEK in options The structural case for SEK appreciation remains intact the real effective exchange rate is 10-11% below its long term average despite an economy that has a positive output gap and which continues to deliver above-trend growth. This week it was reported that Q4’16 GDP jumped by 4.2%.

In addition we upgraded our forecast for Q1’17 from 3.0% to 4.0% (the Riksbank expects 3.2%). The problem for SEK is not the economy but rather monetary policy which is still myopically fixated on delivering at-target core inflation.

A central plank of the central bank’s strategy is too impede a fundamentally justified appreciation in SEK for as long as it can, which is why we expect only a relatively slow pace of SEK appreciation. In order to better reflect the outlook for a slow grind higher in SEK we are converting our cash short in EURSEK into a covered put.

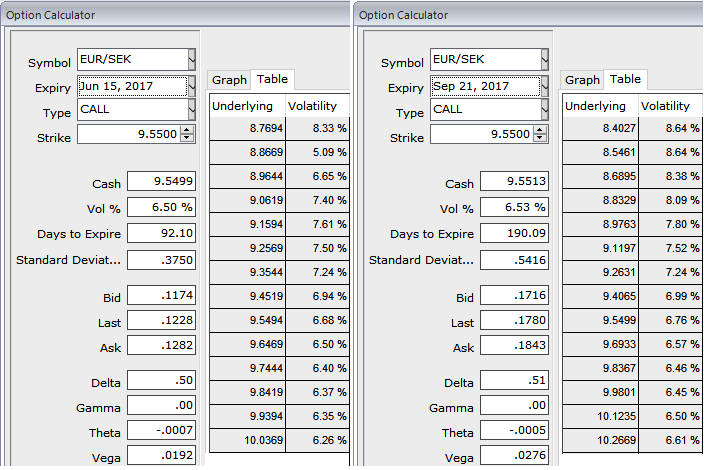

This serves to improve our entry level by around 0.5% and provides some positive time decay as SEK is prone to consolidate in the four weeks between the only data point that matters for Riksbank, CPI. EURSEK vols like all euro pairs are elevated as result of the French election premium so there’s added value in selling lower-strikes in EURSEK at this juncture. 3-mo implied vol of 6.65% compares to realized vol of only 4.9%.

Sell a 3-mo EURSEK put, strike 9.35. Receive 0.52%. Spot reference 9.5533.

Sold EURSEK at 9.4847 on January 13. Stop at 9.6850. Marked at -0.54%.

Bought a 6-mo NZD put/SEK call, strike 6.10 for 1.47%. Spot reference 6.2372. Marked at 0.42%.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes