The GBP forecasts are downgraded in order to mirror less favorable cyclicals (the fragile growth among G10, the less probability of a near-term rate hike) and also to lodge the upward revisions to the EURUSD forecast. While the forecast for EURGBP is lifted from 0.92 to 0.93-94 by the end-2017 vs 0.90.

The projection ponders over a beta between EURGBP and EURUSD close to the long-term average near 0.5% (the 1Y forecast for GBPUSD is 1.34). There is naturally some focus on whether EURGBP could reach parity but we regard that as being much too aggressive in the absence either of an outright UK recession or the failure of Brexit negotiations that heightens the risk of a disruptive Brexit in 2019 (we have rather cut the probability of a hard Brexit defined by WTO rules from 25% to 15%), sources as per JP Morgan.

OTC Outlook and Options Strategy:

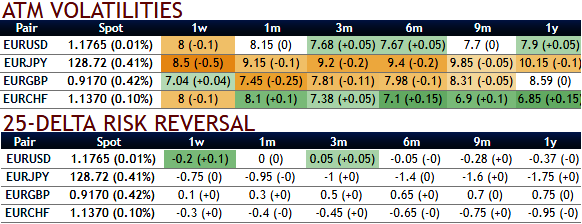

The implied volatility of ATM contracts for near month expiries of EURGBP is a tad below 7.5%, it has remained below 8% across 1-6m tenors, these tepid IVs among G10 FX space appears to be conducive for overpriced call option writes in bullish hedging strategies as the delta risk reversals are also flashing bullish neutral numbers that signify hedging arrangements for upside risks amid minor corrections over the period of time.

While the current IVs of ATM contracts are at higher levels but likely to perceive hover around at an average 8-8.5% in the long run that would divulge pair’s gain contemplating risk reversal arrangements.

Contemplating above OTC market reasoning and fundamental factors we think further upside risks are on the cards, as result we reckon deploying longs on ATM call option with delta being at around +0.51 in hedging strategies are worthwhile and to reduce the cost of hedging we would also like to write over OTM puts as the northward forecasts remain maximum upto 0.94 mark.

Please be noted that the 2m 2% OTM calls are trading at around 14% more than the NPV of this option, while IVs just between 7.4-7.7%. We see this disparity as an optimal opportunity to be utilized for shorts with a view to reducing the cost of hedging.

Hence, hold a 2-month 0.9025-0.9410 EURGBP call spread, marked at 0bp.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand