The UK retail sales showed the first annual decline since March 2013 at the start of the fourth quarter. Sales were up 0.3% compared to September – beating analysts’ expectations of a mere 0.1% rise - but down 0.3% on the same period last year, according to the Office for National Statistics.

Subdued retail sales growth in July reflected an ongoing deterioration in household finances, linked in turn to low pay, rising prices, and concern about the outlook. The data add weight to calls for the Bank of England to hold off with higher interest rates, as increased borrowing costs will add further pressure to family budgets.

Central bank events are delivering: BoC and BoE have been at the vanguard of reshaping non-US rate expectations this year, and their easing up on policy normalization rhetoric in October sparked good-sized spot swings in the immediate aftermath of meetings.

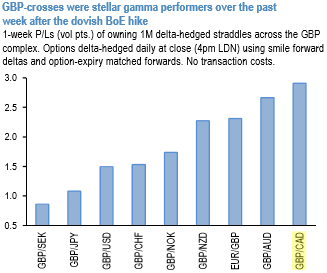

BoE was the latest to join the band of market-moving central banks this past week after its dovish hike pounded the sterling and led to solid gamma gains across the GBP-complex (refer above chart).

The outcome was not entirely unpredictable: it has been noted in the recent past that the mix of near-complete discounting of the November rate move, a heavily priced hiking cycle (100bp) along the Gilts strip and weak data flow in the build-up to the meeting in the context of Brexit uncertainty had raised the odds of sell-the-fact price action in GBP.

While the GBPCAD has been oscillating between a price range of 1.7165 and 1.6350 levels from the last two months. According to this price behavior, we advocate options strategy that is likely optimized hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.6845, initiate long in GBPCAD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1%) out of the money call with positive theta. The short leg with narrowed expiry likely to reduce total hedging cost.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching higher towards 117 levels after retail sales numbers (which is bullish), while hourly CAD spot index was at shy above 25 (bullish) while articulating (at 13:10 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts