Brexit deadline extension has been agreed by the EU, and the UK general election has been scheduled for December 12th, but how exactly the subsequent course of events in the UK plays out is still uncertain.

We perceive a post-general election Conservative majority to likely translate Johnson’s deal into UK legislation in a manner which raises no deal risks at end 2020 as a Conservative majority will bring with it a temptation to reopen the deal to address Brexiteer concerns. Conveniently, the trough of GBP term structure is currently at 1Y tenor, making an outright 1Y to 18M vega ownership attractive.

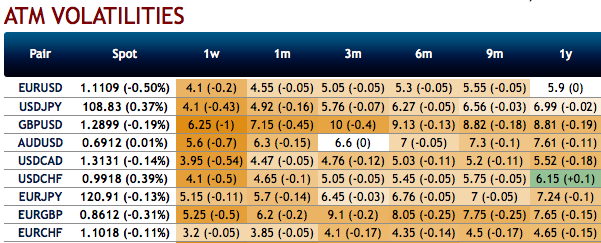

The above nutshell exhibits IVs of G7 FX bloc on lower side. Considering the prevailing sideway trend of cable, the underlying movement with lower IVs is interpreted as a conducive environment for writing overpriced OTM options. While the underlying movement with lower IVs can also offer economical OTM option pricing.

Amid low implied volatility era, we consider options combinations using calendar structures.

One theta- efficient alternative is to consider partially financing ATM straddles with writing 10D strangles.

Selling low-delta wings around potential large dislocations such as a no-deal Brexit seems dubious but the above chart (2nd exhibit) clearly demonstrates a value of such construct.

While systematically buying GBPUSD straddles delivers a familiar, predictably negative return stream typical of long volatility structures, if one were to combine such straddle longs with 10D strangle shorts in less-than-even vega amounts (equal vega amount would correspond to 1.0:2.5 notionals sizing), the risk-reward profile changes favorably.

Namely, the straddle – strangle package turns out to have 0.6 beta to standalone straddles but exhibits a decay of only about 1/3ed to -1/5th of that of straddles.

Hence, consider the below options combinations:

Go long in 1Y GBPUSD or GBPJPY straddle, delta-hedged, @8.6/9.25 and @10.0/10.6 indic, respectively.

Or in a format of a low decay spread as

Adding 1Y GBPUSD straddle vs 10D strangle, delta-hedged, @1.05/1.35 indic, equal USD notionals. Courtesy: JPM

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential