On the eve of the monetary policy season for the week, responding to a deteriorating global economic outlook and rising event risks (largely from US trade policy), the key Fed/BoE/BOJ officials have lately spoken of their readiness and the room to step up on monetary accommodation.

BoJ is also lined up for their monetary policy amid ongoing political uncertainty indicates a continuation of the ‘wait-and-see’ message regarding the timing of the change in MPS.

FX clauses will unlikely to have significant impacts on Japan's FX policies. However, if the US vehemently criticizes JPY weakness, it would be a risk factor giving short-term upward pressure on JPY.

Japanese corporates and investors have strong demands to sell JPY in order to invest abroad. Ahead of Japan's ten consecutive day holiday from late April to early May, they refrained from taking JPY short positions with a relatively fresh memory of a flash crash in early January. While Japan passed the long holiday, they likely see current levels of USDJPY low and might be eager to purchase the pair.

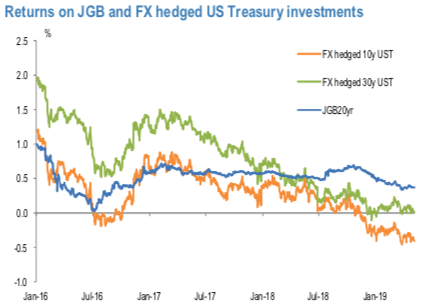

Furthermore, Japanese investors excluding the BoJ will receive ¥44tr of JGB redemption proceeds in FY2019 and this ¥44trillion worth of cash cannot be expected to be deployed in Japan due to the expected low returns. While FX hedging cost in high, we will possibly see foreign securities investments with no hedge (refer daily chart).

There have been some developments for the past month. The most important event was that US-China relationship deteriorated with a possible raise of US tariffs on $200bn worth of imports from China to 25% from 10%, and this led to the deterioration in risk sentiments. This was a shock to the markets as shared consensus was that their talks were making progress and they were not too far from an agreement.

As a result, JPY appreciated. The sudden change in the US attitude towards China and its stronger protectionist stance suggests risks with which the US might go hard on Japan in their trade talks. The looming risks are likely to weigh on USDJPY for the next coming months.

On hedging grounds ahead of Fed and BoJ’s monetary policies that are scheduled for this week, shorting USDJPY futures contracts of mid-month tenors have been advocated, we now like to uphold the same positions as the underlying spot FX likely to target southwards below 106 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is inching towards 52 levels (which is bullish), while hourly USD spot index was at -22 (mildly bearish) while articulating (at 11:26 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates

Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge