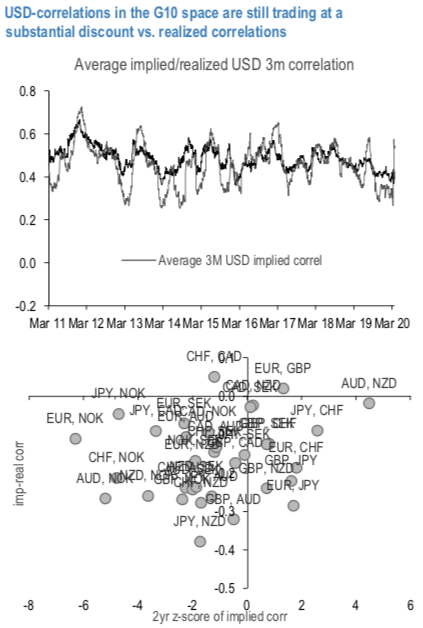

One thing which stuns in the FX space is the lack of repricing of USD-implied correlations, at a time when all risk measures are spiking and measures of Equity-implied correlations reached all-time highs in mid-March.

Long USD correlation and skew positions were recommended as a hedge in a piece published this January, ahead of the market carnage that started a few weeks later.

Long USD skews and correlations offer room for playing COVID-19 hedge trades.

We can see that, at least in the G10 space (refer 1st chart) average pricing of 3M USD-implied correlations remained fairly constant over the past month, trading at a 15 corr points discount vs realized correlation, which spiked over the past two weeks as long USD positions were supported in the risk-off correction.

A more granular analysis in the 2yr z-score of implied correlations vs. correlation premium space shows several cases, amongst which NZDJPY, NZDCHF and GBPUSD (in the latter case, implied trails realized by 32 corr points), where current pricing of implied correlations is attractive. Keeping in mind that liquidity of correlation products might be now drier than during normal market conditions, scouting for cheap entry points in the correlation space does not look like an unrealistic task, even at this point in the COVID-19 crisis. One possibility why this might be the case is that, after a rollercoaster ride, the DXY Index is up a mere 1.5% since mid-February, as an indication that its safe haven status might not be fully trusted by investors.

We recall readers that the simplest way for estimating implied correlations is via a trigonometric identity involving ATM volatilities, as for instance displayed in the charts above. The actual pricing of correlation products, like corr swap, dual-digis, best/worst-of is in addition also sensitive to vol smiles. In the two following charts, we display a simplified case study (refer 2nd chart), for USDJPY vs EURUSD and GBPUSD, where we consider three strikes for each pair (corresponding to 3M ATMF and +/- 25-delta), and compute the implied correlation based on the cross-vol for the equivalent strike (as an example, for EURUSD K1 = 1.0927, USDJPY K2 = 103.88, EURJPY K1,2 = K1 * K2 = 113.51 level).

The resulting correlation surfaces display a marked strike- sensitivity (i.e., they do depend on the skew), as an indication that, for both buyers and sellers of correlation, the choice of the strike, as in dual-digi structures, can be optimized for reaching a desired correlation benefit. In the two cases below, however, the level of the correlation remains negative for all strikes considered, even the one where USD moves in opposite direction vs. the two other currencies (i.e., EURUSD and USDJPY down). After re- expressing the above in terms of USD as a common asset currency for both pairs, USD correlations are then always positive. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis