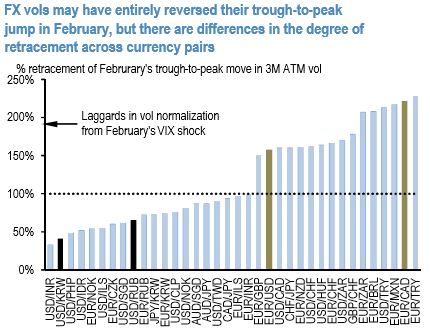

The normalization process is differently advanced across different currency pairs (refer 1st chart) however, creating opportunities for chasing normalization in those that have lagged the broad index sell-off.

KRW and RUB are two of the more liquid names among relative laggards that are worth considering from the short side where trailing realized vols over the past 2-weeks have already dipped below current implieds, and where additional vol selling edge can be extracted by exploiting option surface irregularities.

At the other end of the spectrum, EUR-and EUR/high-beta crosses such as EURCAD, EURTRY and EURBRL have undershot their pre-VIX shock levels and in some cases have even eclipsed YTD lows, hence are ideal as long legs of pair trades.

A relative value construct that takes advantage of the retracement differentials above is to own a basket of 6M ATM EURUSD and EURCAD straddles against selling 6M OTM EUR calls/RUB puts. Implied vol optics may not be exceptional for RUB vol selling by recent historical standards owing to the distortion of the vol surge between 2014-16 brought about by the nosedive in oil prices. The case for RUB vol selling rests realized volatility being capped by the favorable currency macro trifecta of high real yields, current account surplus and a still cheap currency, which in turn is inviting vol suppressing portfolio inflows.

The resulting stock of spec longs can admittedly be subject to periodic washouts, but vol sellers are handsomely rewarded for assuming this risk in the form of a substantial 4-5 % pt. implied –realized vol premium (refer above chart); in any case, part of the heavy cash spec length would likely have been reduced amid the de-risking of early February, hence an encore squeeze is less likely in the near term.

OTM RUB puts rather than ATM vols are the preferred selling target owing to their extreme skew premium, which is anomalous for a fundamentally sound currency in an environment of broad risk-reversal compression even in poorer quality EM FX. EURRUB rather than USDRUB is the preferred vol selling vehicle to provide a degree of cushion against swings in the broad dollar.

The RV is better expressed in longer expiries (6M – 1Y) than in short dates since the implied – realized premium in RUB widens as one goes further out the curve, and also because the belly of the curve is the best value sector of the EURUSD surface to buy. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?