Selling riskies has been a theme that we repeatedly utilized since the March vol episode. Delta-hedged ratio spreads served us well in that regard as they proved efficient in capturing excess risk premium embedded in skew while weathering the intermittent ups and downs in risk sentiment.

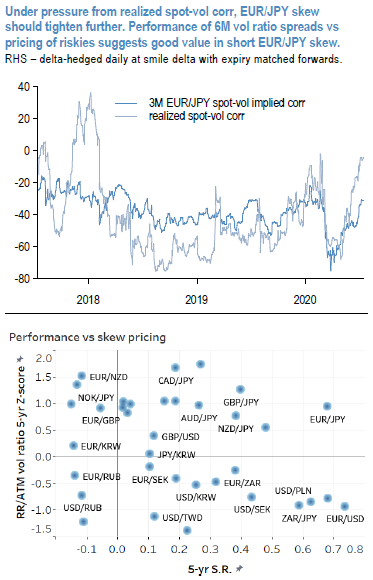

Two weeks ago, we added short skew USDJPY vol ratio spread to our model portfolio. Here we discuss EURJPY skews, as another worthy candidate. Yen vols have been under immense pressure and the skew tightened substantially. While EURJPY skews are now only marginally off from the pre-Covid level the recent markets focus on EUR outperformance puts EURJPY skews squarely in play. 1st chart clearly demonstrates the point. SABR based implied and the trailing realized corr are at odds as the implied correlation has been slow to tighten (i.e., to become less negative) and materially lagged the realized spot-vol corr correction. At this point the 3M EURJPY implied spot-vol corr is more than 25pts wider than the realized spot-vol corr, the spread last seen in early in 2018 around the Italian general election.

Historical performance of delta-hedged ratio spreads and the current pricing of riskies suggests good value in short EURJPY skew (1st chart - bottom).

Moreover, our analysts look for the yen to remain flat to the dollar through 2H’20, with a bias for moderate JPY appreciation only through early 2021. If those expectations realize yen skew is bound to underperform. With the recent focus on EUR outperformance as EURUSD crossed 1.14 levels, we see EURJPY skews a good place to skim the leftover x-yen

skew theta even though the EUR positioning is starting to look a bit stretched as it’s approaching 2018 high and may dampen the force of upside pressure and chances

for further gains.

Our analysts acknowledge tactical upside risks to their EUR view even if no enough positives to sustain a medium-term EUR renaissance. EURJPY spot is already at their 121 Q3 target. A muted spot is playing right into the hands of a short EURJPY skew trade and the balance of near-term risk reassures us that yen calls pricing would remain contained.

2nd chart displays a strong systematic performance of short EURJPY skew nearly irrespective of the skew pricing.

Long term risk-adjusted performance is also fairly similar across tenors with lower vega P/Ls per trade collected for longer expiry tenors but also exposed to proportionally lower drawdowns. On choice of option structures, the 10-yr backtest shows virtually identical risk-adjusted performance of delta-hedged put spreads and delta-hedged riskies though considering the current market backdrop (i.e. if expectations for EUR outperformance indeed realize) our lean is for delta-hedged short risk-reversals (i.e. short EURJPY 25D puts and long EURJPY 25D calls).

Amid the US election risk we prefer pre-election short expiries, consider shorting 3M EURJPY 25d delta-hedged risk reversal @1.1/1.4 indicative. Courtesy: JPM

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes