Vey recently many voiced surprising tone at this juncture about the JPY weakness. Neither the recent Bank of Japan’s recent measures to cap long-term yields close to zero nor BoJ governor Haruhiko Kuroda’s dovish comments was entirely new. Why did the market react the way it did?

The central banks in G7 nations are lined up to announce monetary policy announcements, BoC on 12th July, BoJ and ECB on 20th July, FED on 26th July and BoE on 3rd Aug.

It was not the first time when the BoJ announced an auction last Friday at which it would buy unlimited bonds at a fixed yield. It is its self-set objective, which it first announced in September last year, to keep the yield curve at -0.1% at the short end and at 0% at the long end. None of that is indeed new.

However, what is new is the global monetary policy environment. An end of the expansionary monetary policy is being discussed almost everywhere. The ECB is likely to announce a further tapering of its asset purchasing programme before the end of the year and the markets are pricing in a first rate hike for next year.

Also, the Bank of England is likely to raise interest rates soon in the view of the markets. And the market even expects to see the Bank of Canada to start a rate reversal tomorrow. Even Riksbank and Norges Bank have recently dropped their easing bias (i.e. the reference to a possibly more expansionary monetary policy) and are thus slowly but surely moving towards an exit.

Of course, the BoJ does not deviate completely from this trend. BoJ governor Kuroda has already admitted openly that the central bank probably will not reach its bond purchasing target of JPY 80 trillion this year.

OTC outlook and options strategy:

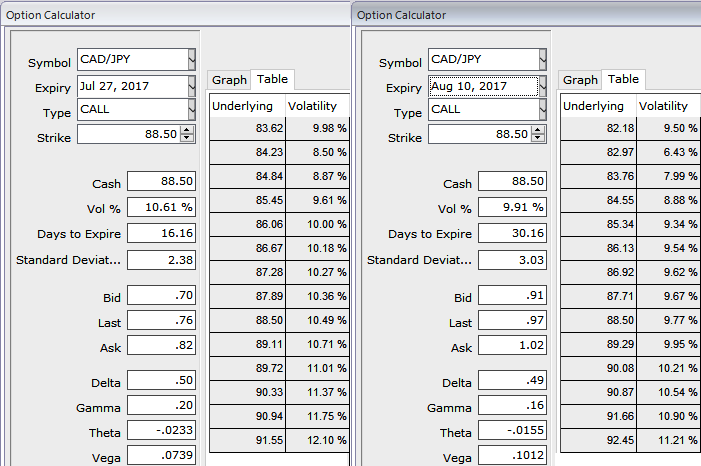

Please be noted that call options of 1m and 2m tenors are trending higher at 9.16 and 9.34% respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2w expiries.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom