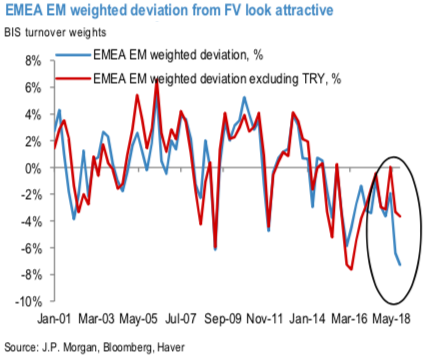

Although the summer FX weakness has produced some pockets of value within EMEA EM, we recommend being very selective.

We update below our BEER FV models (see here for the framework). On aggregate, the EM FX sell-off has led to the largest undervaluation since we started the models in Jan-01. However, a substantial portion of this undervaluation is driven by the sell-off in TRY (refer above chart). Excluding Turkey from the sample, the average undervaluation is much more modest. However, we believe only PLN, CZK and, strictly via options, RUB offer value worth positioning for.

September PMIs published yesterday were noticeably softer than previous readings, with the exception of Russia. The latter had been languishing in recent months but rose to just above 50 for September - possibly as a result of rising oil price. That aside, the Polish PMI fell all the way towards 50 from around 53 a couple of months ago, the Czech PMI fell to a level last seen in late 2016, and the Hungarian PMI slipped by 2.2pts. A synchronised downswing is now recognisable in the data. PMIs for Turkey and South Africa have anyway been diving and they reached low 42-43 levels by September - but these are more idiosyncratic.

Overall, the downtrend in PMIs matches the downtrend observed in German orders over the past quarter, and in turn, strengthens our existing view that GDP growth will decelerate going forward. This is one of the reasons we expect EURPLN and EURHUF to trend up over the coming year.

Well, we maintain UW FX overall. In CEE, we remain OW CZK and PLN vs UW RON and HUF. We are bearish high yielding currencies with UW in TRY and ZAR. Courtesy: JPM, Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -81 (which is bearish), while hourly USD spot index is inching towards 39 levels (which is mildly bullish), while articulating at (13:18 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data