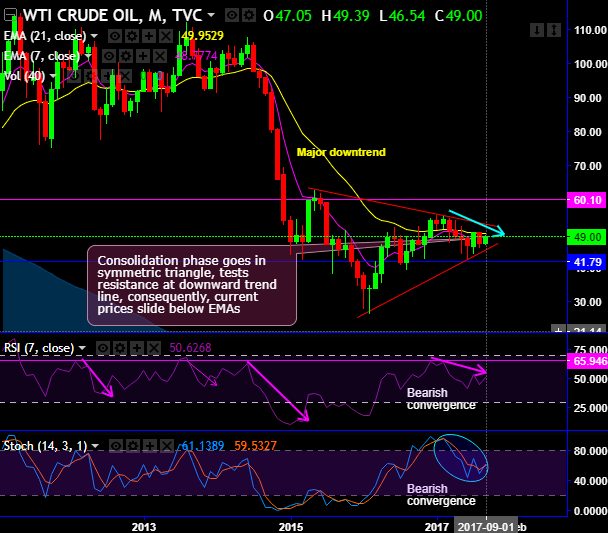

Capitalizing on puzzling rallies of WTI crude prices major downtrend, one can load up shorts in ITM puts as shown in the above diagram of credit put spread but preferably use this strategy with a narrowed strikes and tenors.

While major downtrend could be arrested by the longs of the underlying pair with longer tenors as you’ve seen the selling momentum is intensified by leading oscillators with mammoth volumes on long term technical charts (refer monthly chart).

So, contemplating momentary rallies, it is advisable to initiate Credit Put Spread (CPS) in order to tackle both short term upswings and major downtrend.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

As we expect the retest of recent lows of 44.98 or below in the weeks to come amid any abrupt upswings.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases.

Well, in above case of diagonal credit put spreads, the strategy could be constructed at the net credit, the short leg would be absolutely at profits when underlying spot remains either at strikes chosen or at higher than strikes on the expiration of short side.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data