The Bank of Japan (BoJ) got its Christmas presents on 8th November: since the US Presidential elections the yen has been under pressure against USD. Thanks to Trump. As a result, the BoJ can be a little more relaxed when facing the next round of ugly inflation data tomorrow.

It will stick to the control of the yield curve for the foreseeable future, which means getting the Fed to do its work for it. Does that make it any more likely that it will reach its inflation target? Hardly, but at least it eases the pressure on the BoJ.

OTC outlook:

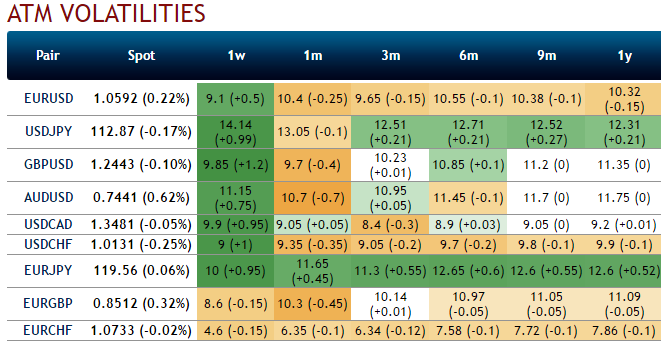

Yen vols were a marked outperformer this year as USDJPY shed nearly 17% peak-to-trough, but this is likely to change going forward under the aegis of the BoJ’s yield curve control framework that has worked to anchor JGB yields better than we expected, and as the pair encounters offsetting forces of higher US-Japan rate differentials and greater risk-aversion from EM weakness.

USDJPY risk-reversals: As a result of the above fundamental developments, the hedgers of USDJPY began bidding OTM call strikes as you could see positive changes in risk-reversals. But these numbers in longer tenors are still very much a work in progress as far as vol selling opportunities go, with current levels (3M risk reversals at 12.5 vols & with increased pace in 6m vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), while 3m IV skews to substantiate bearish hedging offered by risk reversals. But short-term risks reversal bets signals the higher potential of USD.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

Hence, contemplating above risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

From positive risk reversal flashes you can probably figure out hedging operations for upside risks in both in short run and long run are intensive, while 1m IV skew also signifies the hedging interests in OTM call strikes.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence