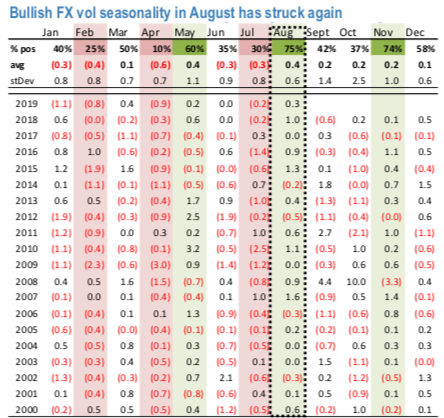

The brutal late-summer bullish seasonality of FX vol (refer 1stchart) has re-asserted itself following an eventful FOMC meeting and a rather more dramatic turn of events on US/China trade towards the fag end of the week. Before being overshadowed by the Presidential tweets that upended any lingering hopes of quiet late summer markets, the “hawkish” Fed cut at the July FOMC could reasonably have been expected to be the marquee event catalyst of the week likely to produce durable market impact over the next few weeks.

A consensus had begun to emerge around soft US exceptionalism and contained dollar strength in the lead-up to the September ECB, as uber-dovish Fed expectations were revised to reflect a more reasonable assessment of concurrent US activity data, and the old strong-US-weak- Europe cyclical/policy divergence narrative revived.

The latest tariff threat from Trump emphatically reinforces this notion of dollar bullishness; the crucial difference for FX volatility is the potential for greater velocity and urgency to dollar rallies than might have been previously anticipated. The net result is a sharp re-pricing higher of front-end implied vols across the board, with the largest increases focused on Asian currencies in the eye of the storm and China-linked high-beta EMs such as ZAR (refer 2ndchart).

In light of the further escalation in the US-China trade conflict, we are revising our USDCNY forecast profile higher. As we have noted in recent research (see China FX focus: Life after 7.00) the risks around a break of 7.00 have arguably never been greater. With tariffs likely to be applied to the remaining set of Chinese exports to the US, upside pressure on USDCNY should only increase, as a weaker currency should be part of the first-order response to such a loss of competitiveness. This has been evident in 2018 and in May of this year after the US raised tariff rates on Chinese exports. Courtesy: JPM

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation