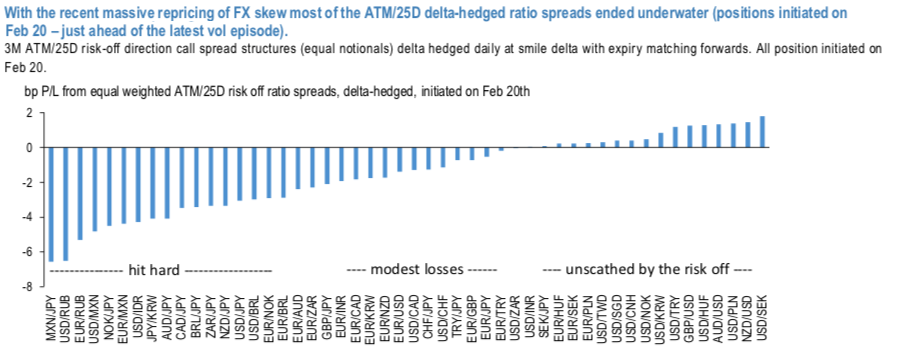

The entire global market sentiment has been driving strictly defensive positioning we think that it is prudent to keep an eye on historic skew dislocations their theta-scalping via risk off ratio spreads (delta-hedged). Those are a class of structures that can efficiently monetize excessive risk premia in vol smiles. While ratios can be struck for both calls and puts, the recent vol episode pushed the pricing of risk of OTM strikes into uncharted territory and made of particular interest the structures where the short notional is placed on the “risk-off” side, i.e. selling risk-reversals. While such structures are quicker in collecting premium, exposure to left tail is notable.

The brutal sell-off in crude oil prices as occurred over the past weekend led to a sharp repricing of vols and skews of oil-exporting currencies, most notably, RUB, NOK and CAD. A closer inspection reveals that outside of the EM petro-currencies and yen high beta crosses, the losses in risk-off ratio spreads were moderate (refer 1st chart). This is encouraging as the currently elevated levels of skew pricing should provide a buffer from incurring further losses if spot- vol correlation picks up again.

USDCAD vols risk-off call ratio spread is an outlier that dominates 2nd chart where currency pairs are screened based on 3-year Sharpe (a medium term performance horizon) of risk off ratio vol spread structures and 1y z-score of skew / ATM vol ratio.

3M USDCAD delta-hedged ATM/25D call spread @9.8/10.3indic vs 12.7ch, equal notionals to keep the structure net long vega.

An alternative way for benefiting from elevated skew, while offering at the same time risk-off exposure, is via directional (not delta-hedged) call spreads. Especially in the case of CAD, a regression analysis finds that the latest move in Oil well justifies the changes in vol and skew, but that there is further room for spot to move higher (about +3% of upside based on the past 3m change in Oil prices).

Consider: 3M USDCAD 1.40/1.4280 strikes (40D/30D) call spread (live, no delta-hedge) costs @55bps USD (spot ref. 1.3860), 3.5X max payout / cost ratio. Courtesy: JPM

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand