Despite the breakdown in trade talks between the US and China at the end of last week, which saw the US increase tariffs of $200bn worth of Chinese goods to 25%, broader market sentiment seems to have stabilized. US equities are finding buying interest on the current pullback, while the USD vs G10 remains in its short-term range.

While the lingering BoC and USMCA risks give a clear directional bias for CAD. Meanwhile, medium-term view on NOK is modestly bullish on gradual rate hikes. The setup is favorable for financing CAD downside by selling NOK downside, especially considering that our swaptions-FX vol framework sees value in CAD options ownership and instructs us to sell NOK options.

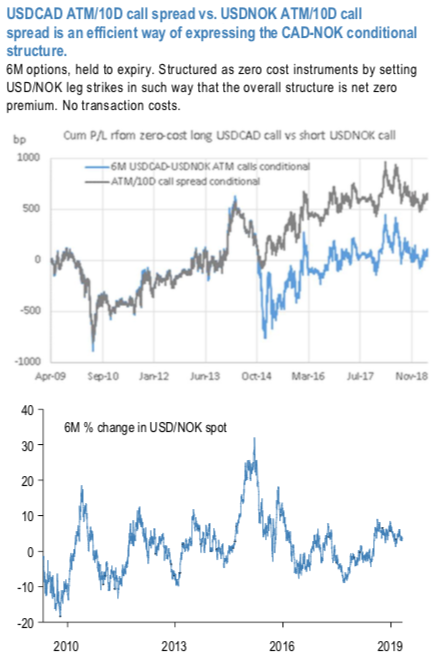

One additional twist is in utilizing call spreads instead of unlimited downside call conditionals. Even though still at very modest levels, the ratio of OTM USDCAD calls to ATM calls is at the highest in almost 2 years, suggesting value in selling OTM strikes in form of call spreads.

The construct outperformed the standard USDCAD ATM call vs USDNOK ATM call, as the loss-capping mechanism intervened on the short USDNOK leg during the massive USD rally in 2014 (refer above chart). Other than loss capping, the structure shows nearly 100% exposure to the historically observed upside, with USDCAD skew historically underperforming.

Trade recommendation: Buy 6M ATM/10D USDCAD call spread, financed by shorting 40D/7D USDNOK call spread, in a zero cost structure, not delta hedged. Courtesy JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards 55 levels (which is bullish), while hourly USD spot index was at -34 (mildly bearish) while articulating (at 11:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge