On the back dollar strength, gold futures were down 1.07% at $1,341.7 a troy ounce by 02:00 a.m. ET.

Gold vols skews should stay well supported and have room to widen striking 3M delta-hedged 25 delta riskies as a good value, positive vol carry risk off hedge.

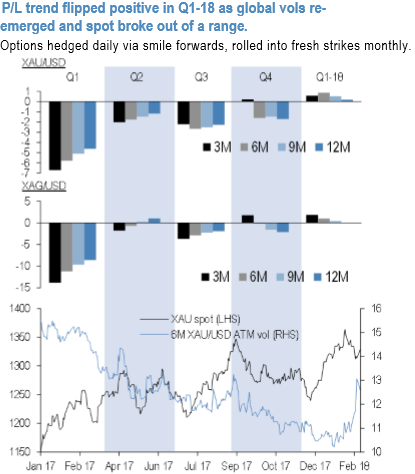

Coming off a downbeat 2017, precious metals long vol trades started to make money in Q1 2018 (refer above chart). Safe haven assets vols were sharply higher on the back of the recent global vols rally that got an additional kicker from the full-blown equity markets panic that followed the Feb 2 hourly earnings print. Between the strong US CPI print and disappointing retail sales last Wednesday the markets seems to be getting a cue that the panic is over

Front-end Precious metals vols rebounded, at last. With a number of upcoming catalysts bound to keep realized vol tactically firm, XAGUSD strikes us as a solid defensive gamma hedge especially when paired in an RV with AUD in a delta-hedged XAG –AUD 25D put spread.

Buy 3M XAGUSD @ 18.6/19.25 vol vs sell AUDUSD @ 9.9 vol indicative 25 delta puts, in vega neutral notionals.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 139 levels (which is highly bullish) while articulating (at 08:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close