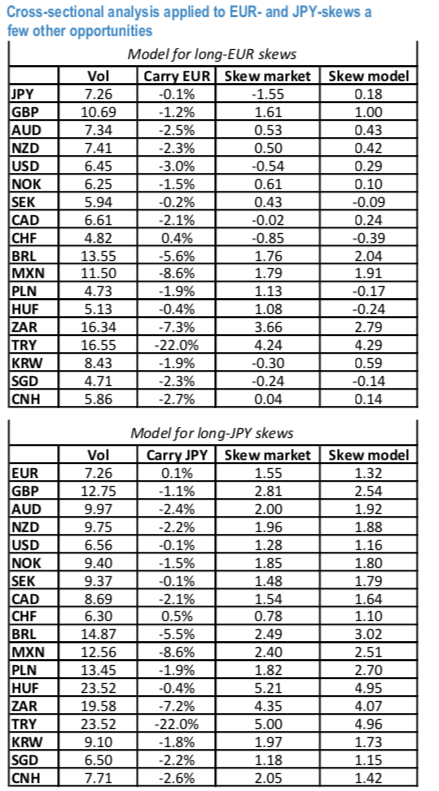

We go and repeat the cross-sectional analysis by considering EUR and JPY as the base currencies (refer above nutshell). The R2 of the 2-d regression analysis on the EUR has associated a lower R2 (75%) than for USD and JPY (above 85%). As for the USD analysis, there appears to be room for buying EUR- and JPY-skews against Latam currencies, especially BRL. The analysis for EUR-crosses confirms the earlier result that EUR calls offer excellent value for hedging a drop of the USD.

In this write-up, we summarize as to how the results could be used in practice. For trading purposes, one would naturally look to enter skew trades which offer:

a) a positive dislocation potential, and

b) a natural risk-off exposure.

Having incorporated the carry component embedded in risk-reversals, the dislocation analysis should permit highlighting pairs where delta-hedged skew constructs are attractive from a Carry standpoint. Adding the further constraint of risk-off sensitivity allows selecting long-convexity trades where the cost of Carry is not punitive. The long EUR-skew vs CNH (EM vol has peaked for now,) would naturally fall within this category: here the 2.7% per year carry would call a higher level of implied skew than what is currently priced by the market. A few other opportunities that stand out from this perspective could be the cheap AUD and NZD riskies against the USD or the cheap SEK risk-reversal against the JPY. Based on this measure, when taking into account the contribution of carry and volatility TRY risk-reversals generally screen as fairly valued.

For hedging purposes, the potential of applying these relative-value analyses obviously depends on the specific FX-sensitivities a given institution is exposed to. If we consider international institutions invested in the US market, it would be appealing to find carry-friendly constructs for replacing the costly forward hedges. At present, the RV analyses above support buying EUR calls / USD puts as a hedge of the long USD positions held by European asset managers, especially given that, unlike most other currencies, the richer side of the skew (USD calls) is also the one where one gets a positive Carry in the cash market. We don’t see a similar “arbitrage” opportunity for the JPY-based investors, given that JPY calls are higher than USD calls, due to the effect of the forward points. More generally, for each currency, one could screen for long-currency skews which are cheap based on the metrics above and which could offset a short-currency exposure in the cash market.

A third possibility would regard the pure-RV implementation of the signals above: finding pairs of assets where the level of carry is comparable, but where the relative pricing of skews is dislocated, and entering a long/short trade, delta-hedged. For the JPY-crosses, one could buy PLN riskies and sell HUF riskies, for instance.

GBPUSD risk-reversals screen as overvalued for the three base currency cases considered here: given the uncertainty concerning the Brexit process, with just one month to go to the 29 March expected deadline, we find that a skew premium is perfectly justified, and we stay away from the temptation of fading the short-dated skews just based on this analysis. Conversely, the premium embedded in GBP risk-reversals would offer UK-based asset managers the opportunity of hedging their foreign assets via long GBP calls / short GBP puts constructs. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 150 (which is bullish), while hourly USD spot index was at -123 (highly bearish) while articulating (at 12:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty