The RBNZ today cut the OCR 25bps to 1.50%. Both the market and analysts were divided on what action the RBNZ would take today, meaning a market reaction was guaranteed either way.

Consequently, the majority of NZD pairs have dropped considerably today. NZDUSD down by -0.10%, NZDJPY slipped -0.20%, NZD sank -0.30% and -0.28% against Euro and Aussie dollar respectively, we could foresee more slumps on the cards in the days to come.

The RBNZ struck a dovish tone, noting that global economic growth has slowed but also that some indicators had improved lately, while on the domestic front, “the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly”. In sum, “The Monetary Policy Committee decided a lower OCR is necessary to support the outlook for employment and inflation consistent with its policy remit.” We agree, as it happens, but had believed on balance that they would require a little more evidence before leaping into action.

The Committee did not give strong guidance that further cuts could be expected, describing the outlook for interest rates as now “more balanced”. The OCR is forecast to be at 1.48% by the end of the year, implying they do not expect to be cutting again anytime soon. The track implies a 50% chance of a further cut sometime next year but then increases over the projection.

OTC Updates and Options Strategy:

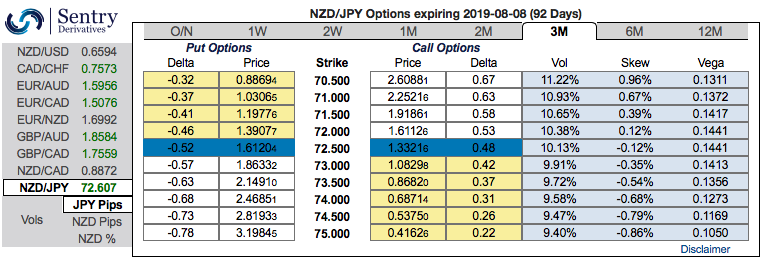

To substantiate above bearish stance, the 3m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts up to 70.500 levels.

As a result, we construct suitable options strategy favoring slightly on the bearish side. Initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce the cost of hedging with time decay advantage on the short leg, while delta longs likely to arrest potential bearish risks. Courtesy: Anz & Sentrix

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -103 levels (which is highly bearish), JPY is at 57 (bullish), while articulating (at 07:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data