NBP held its first rate-setting meeting of the year today: The National Bank of Poland held its reference rate at a record low of 1.5 pct on January 10th, 2018, as widely expected. Also, the Lombard rate and the deposit rate were kept unchanged at 2.5 pct and 0.5 pct, respectively, and the rediscount rate was left at 1.75 pct. The central bank ended an easing cycle in March 2015.

The governor stuck to his stance that rates are likely to remain flat until the end of 2018. Since that time, data have in fact supported a dovish stance: inflation has dropped back to below-target 2% in December and core inflation remains subdued at just c.1%.

Additionally, the MPC no longer refers to a tightening labor market as a source of risk. The MPC current balance between doves and hawks suggests that no rate hike is likely until H2’2018.

The zloty has staged a significant rally over the past month, but this has been part of a broader rally in EMFX – the zloty has not outperformed peers such as the forint over the past month. We forecast EURPLN to gradually rise through this year.

Accordingly, we’ve already advocated credit call spreads a month ago on 5th of last month, please go through below weblink for further reading on the same:

Well, short leg so far has functioned very well as per its objective. Now, it is on the verge of fetching positive cashflows in long legs.

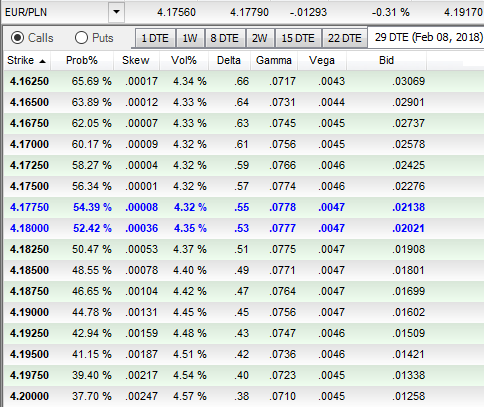

At spot ref: 4.2046 back in 5th December, we had advocated shorts in EURPLN and 1m2m diagonal call spread (4.1650/4.2650). The underlying spot FX trend and IV skews of 1m tenor have been favorable to long OTM calls.

At prevailing spot rates at 4.1857 levels, we uphold longs in OTM calls on hedging grounds.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand