NBP held its first rate-setting meeting of the year today: The National Bank of Poland held its reference rate at a record low of 1.5 pct on January 10th, 2018, as widely expected. Also, the Lombard rate and the deposit rate were kept unchanged at 2.5 pct and 0.5 pct, respectively, and the rediscount rate was left at 1.75 pct. The central bank ended an easing cycle in March 2015.

The governor stuck to his stance that rates are likely to remain flat until the end of 2018. Since that time, data have in fact supported a dovish stance: inflation has dropped back to below-target 2% in December and core inflation remains subdued at just c.1%.

Additionally, the MPC no longer refers to a tightening labor market as a source of risk. The MPC current balance between doves and hawks suggests that no rate hike is likely until H2’2018.

The zloty has staged a significant rally over the past month, but this has been part of a broader rally in EMFX – the zloty has not outperformed peers such as the forint over the past month. We forecast EURPLN to gradually rise through this year.

Accordingly, we’ve already advocated credit call spreads a month ago on 5th of last month, please go through below weblink for further reading on the same:

Well, short leg so far has functioned very well as per its objective. Now, it is on the verge of fetching positive cashflows in long legs.

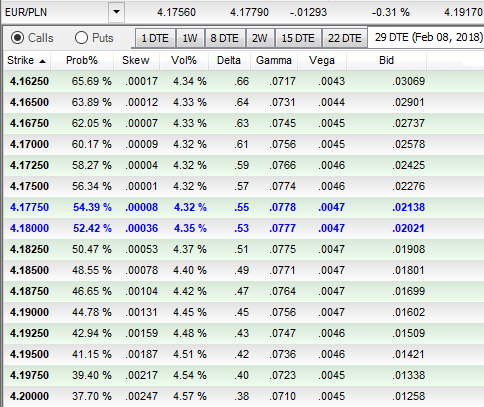

At spot ref: 4.2046 back in 5th December, we had advocated shorts in EURPLN and 1m2m diagonal call spread (4.1650/4.2650). The underlying spot FX trend and IV skews of 1m tenor have been favorable to long OTM calls.

At prevailing spot rates at 4.1857 levels, we uphold longs in OTM calls on hedging grounds.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One