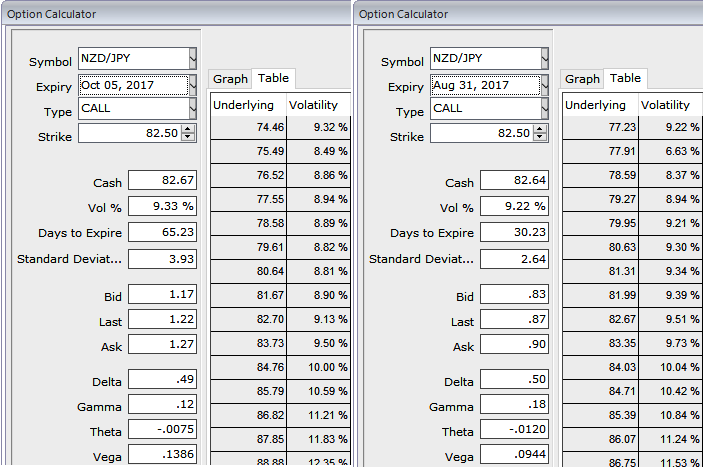

Please be noted that call options of 1m and 2m tenors are trending higher at 9.22% and 9.33% respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

The RBNZ has signaled the next cycle – a tightening one – would not begin until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which would mean occasional spikes in the 2yr swap rates will be likely.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of same expiries, the strategy is constructed at the net delta of 50% as shown in the diagram.

This NZDJPY strategy should take care of both upswings and downswings simultaneously, and on speculative grounds, the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on the upside.

Straps are unlimited returns and the limited risk options trading strategies that are used when the options trader ponders over the underlying spot price would sense significant volatility in the near term and is more likely to rally upwards instead of plunging downwards.

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at -12 levels (which is neutral), while hourly JPY spot index was at shy above 44 (which is mildly bullish) while articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge