Following yesterday’s Bank of Canada (BoC) meeting the question arises as to whether the central bank is still in control.

Its view of the economic situation and therefore in the end also its future monetary policy depend on the expected trade policies of the new US President Donald Trump.

In the end, the BoC has no choice but to hope that CAD will not appreciate excessively. And even in this respect, it depends on external factors such as the oil price.

Amid the mixed bag of data, and not supportive of a material shift in BoC stance.

OTC updates and hedging vehicles:

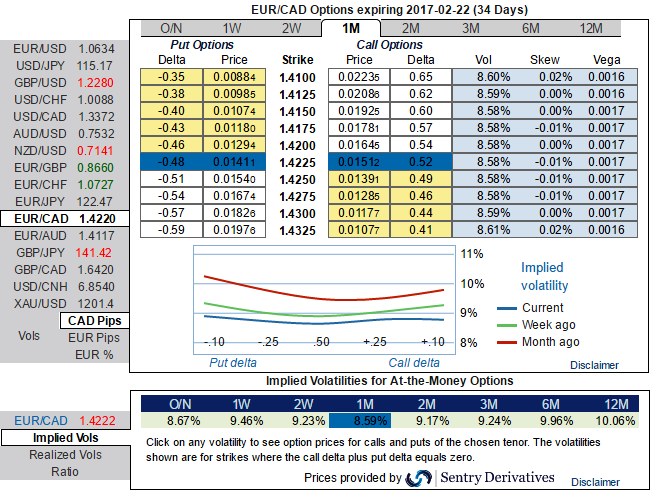

Hence, at spot ref: 1.4224 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. After a series of bullish attempts in this month, we are inclined to position for the major trend continuation of the downward move through put spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using any abrupt rallies, you decide to initiate a diagonal debit/bear put spread (DDPS) at net debit, 1w ATM IVs of EURCAD is just a tad below 9.5%, and skews in 1m tenor are equally distributed towards both OTM call and put strikes.

The execution: Initiate shorts in 1W (1.5%) out the money put with positive theta, simultaneously, buy 1M in the money -0.5 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.cen

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness