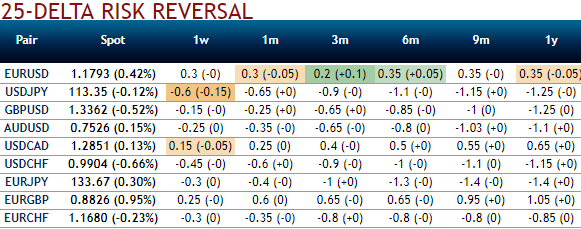

Amongst these crosscurrents, next week’s FOMC meeting might seem a sideshow. The meeting should deliver a rate hike that is largely priced, with even odds that the Committee adds the fourth dot to its 2018 projections, you would probably agree with this fact if you glance through the above nutshell evidencing Risk reversal matrix and IV skews.

25-delta risk reversals show the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. EURUSD’s 25-delta risk reversals of 1m tenors dropped by -0.05 to signify the enhanced demand for the bearish bets (Puts). Whereas the long-term hedging activities for the bullish risk sentiments remain intact if you observe the risk reversals of the 3-6m tenors.

While the IV skews still well balanced on either side to indicate the turbulence in the OTC market.

We’ve already stated in our previous post that The Federal Reserve is no longer expected to pause the rate hike cycle early next year for two main reasons. First, the nomination of Governor Powell as the next Fed chair, in our view, represents a vote for continuity of policy. Second, the unemployment rate is falling again. At 4.1 percent, the risk of a substantial undershoot is rising, Barclays Research reported.

Meanwhile, the dollar is trading about 5% higher, in real terms, than its average level of the last 20 years, and some 23% above the 2011 low. With the global economy Surfing the global expansion, and growth becoming more balanced and more synchronized, the dollar looks expensive. It rallied on the back of the Fed’s lead in the monetary policy cycle.

Not only is the rest of the world slowly catching up, but it seems increasingly clear that the Fed will remain extraordinarily cautious in its policy moves. We expect the Fed Funds target to peak at 2.00-2.25%, which is consistent with real 10y yields peaking not far from current levels (52bp) and well below the 72bp we saw in December 2016.

That’s not negative for the dollar but means that the currency is vulnerable both to its high valuation and to improving FX fundamentals of other major currencies, including but not limited to the euro.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -46 levels (which is bearish) while articulating (at 10:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary