The possibility of a narrower trade deficit in the United States in 2019 have significantly energized the USD bulls, as narrowing of a trade deficit is not only positive for the currency over the longer horizon, it creates a shortage of the currency funded through its current account deficit in the shorter term (more than a year). The narrowing of the trade deficit is of utmost importance, if that currency is the world’s primary reserve currency, used in almost 40 percent of global transactions.

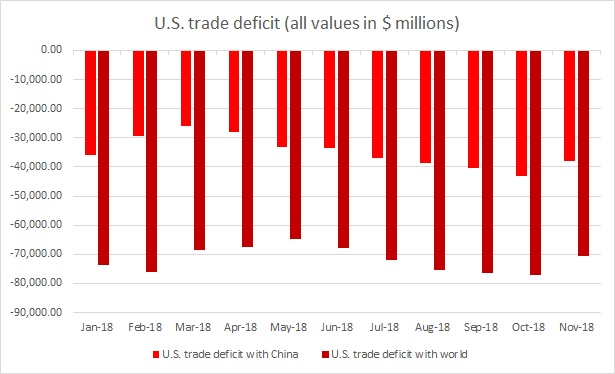

Last night, U.S. Commerce Department released November trade statistics, which shows that the goods trade deficit has declined significantly in November, largely due to deficit decrease with China. However, despite the sharp narrowing, the U.S. trade deficit with China and the rest of the world would be larger in 2018, compared to previous years. See chart for greater clarity, all data currently delayed due to U.S. government shutdown, which temporarily ended until February 15th.

In addition to the narrowing of trade deficit, the declining interest rate expectations in Europe, other countries like Australia, along with U.S. economic divergence are also fueling the current USD rally.

The U.S. dollar is up for the six consecutive days after bottoming around 95 area. Currently, the index is testing crucial resistance above 96 area. Though it might retrace some of the gains made from this level, we expect the USD to rally to sustain longer than just this week.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022