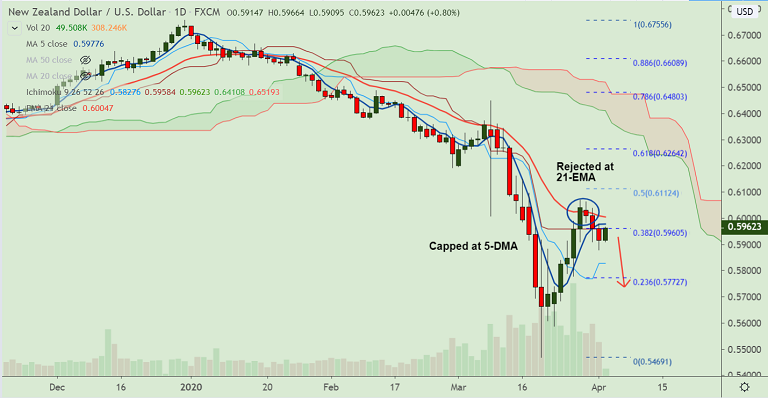

NZD/USD chart - Trading View

NZD/USD was trading marginally higher in the Asian session, recovery lacks traction.

The pair has paused three straight sessions of downside, but bias remains bearish.

The sentiment remains risk-averse as evidenced by risk-off action in the stock markets.

Technical analysis supports weakness. Major trend is bearish and minor trend is neutral. Upside remains capped at 5-DMA.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) keeps check on upside in the pair.

Fears of a prolonged recession likely to cap gains seen in NZD. Focus on US Jobless Claims for further impetus.

Analysts expect the US initial jobless claims for the week ended March 27 to exceed 4.45 million versus preceding week's figure of 3.283 million.

Support levels - 0.5888 (200H MA), 0.5827 (Tenkan sen), 0.5772 (23.6% Fib)

Resistance levels - 0.5978 (5-DMA), 0.6005 (21-EMA), 0.6112 (50% Fib)

Guidance: Good to stay short on break below 200H MA (0.5888), SL: 0.6000, TP: 0.5830/ 0.5775/ 0.57

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025