Although we've been observing some bounces, we could foresee some declines in NZDJPY with a dubious eyes on Kiwi fundamentals comparitively which are not that conducive for the currency and hence, we maintain long term bearish trend in our opinion.

Keeping maximum tenor on long side and time decay advantage:

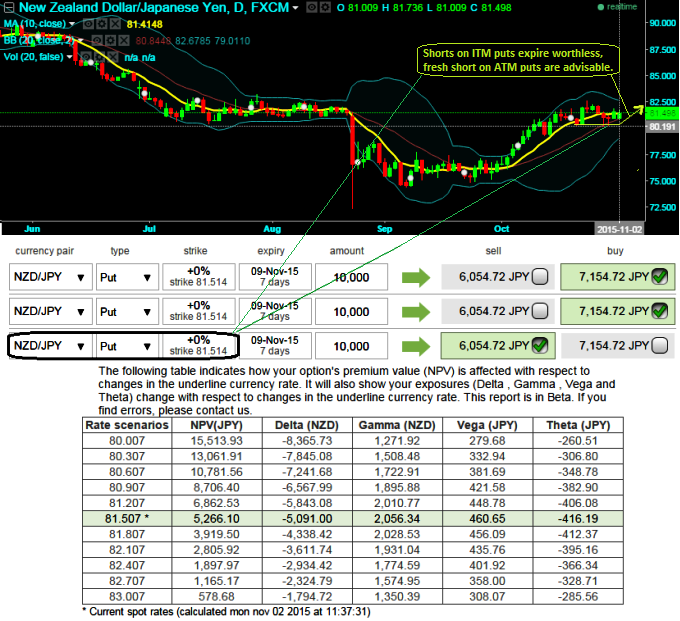

Those who've already deployed ITM shorts with shorter tenor in the recent past would have capitalized on recent surge in rallies of NZDJPY (see daily technical charts), you have nothing worry about this now as they've expired worthless.

Good sign for put holders: The pair is likely to perceive implied volatility close to 14% which is inching lower from 17%, holding 2 lots of ATM -0.50 delta puts or 1 ATM -0.50 delta and 1 OTM -0.71 delta put option with longer expiries (15D or 1M) since implied volatility is inching lower which is good for option holders.

We've seen in the last post, using shorter tenor contracts on short side has helped us options expiring worthless and lock in profits, conversely, in the same way let us keep maturity a bit lengthier on longs.

Giving a longer time to expiration for long sides so as to make a substantial move on the downside so that assignment can be covered by the long puts like opposite to the time decay and implied volatility work in your favor on the short sides.

FxWirePro: NZD/JPY shorts in put ladder reassure certain yields on rallies – longs functionality underway

Monday, November 2, 2015 7:23 AM UTC

Editor's Picks

- Market Data

Most Popular

8