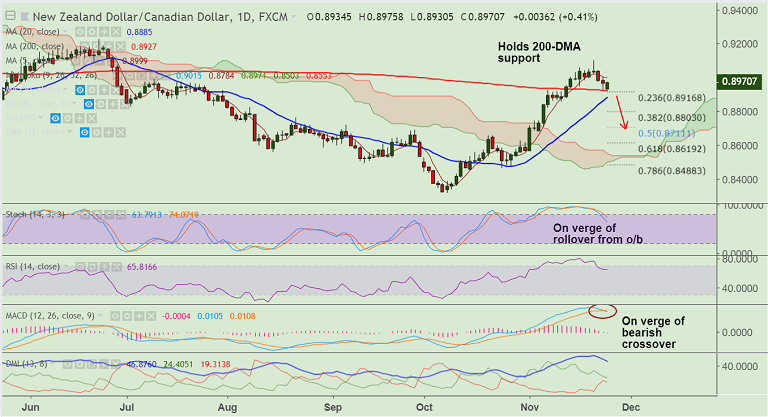

NZD/CAD chart on Trading View used for analysis

- NZD/CAD holds strong support at 200-DMA, edges higher from session lows at 0.8927.

- The pair is trading at 0.8972, up 0.04% on the day at the time of writing.

- The kiwi has largely ignored miss in New Zealand Q3 retail sales data.

- New Zealand’s retail sales volumes were unchanged in Q3, versus expectations for a 1.0% q/q lift.

- “Today’s print presents some downside risk to our preliminary forecast for Q3 GDP growth of 0.6% q/q", said Analysts at ANZ.

- The pair is extending weakness with 'Gravestone Doji' formation at highs in last week's trade.

- We also find that the momentum indicators on daily charts are on verge of rollover from overbought levels.

- Pair has tested 200-DMA. Breach there could see dip till 20-DMA at 0.8885.

- Major trend remains bullish. Failure to break below 200-DMA will see resumption of upside.

Support levels - 0.8927 (200-DMA), 0.8885 (20-DMA), 0.88 (38.2% Fib)

Resistance levels - 0.9000 (5-DMA), 0.91 (Nov 21 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-CAD-halts-upside-with-Gravestone-Doji-formation-dip-till-08844-likely-1462380) has hit TP1.

Recommendation: Watch out for break below 200-DMA for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close