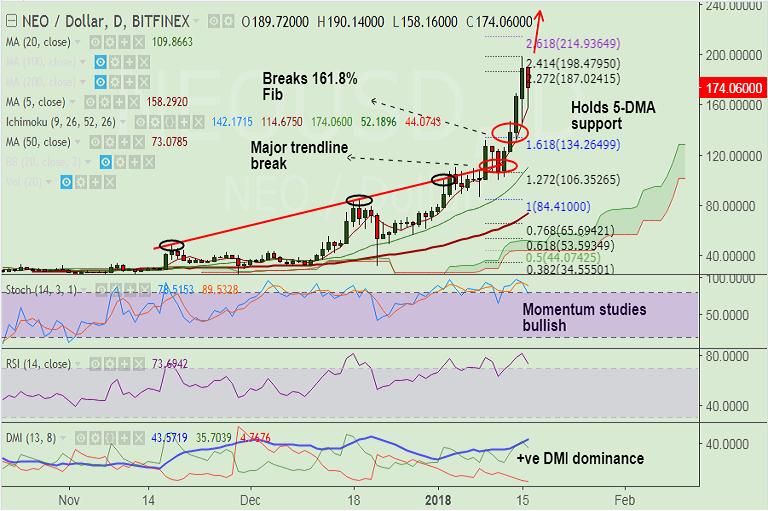

- NEO/USD grinds higher, hits fresh all-time highs at 198.20.

- Upside in the pair pauses at 241.4% Fib extension at 198 levels. Has pared some gains to hit lows at 158 levels.

- Downside has found strong support at 5-DMA at 158.12, we see weakness only on decisive break below.

- On the upside, breakout at 241.4% Fib to see test of 261.8% Fib extension at 214 levels.

- Technical studies support further upside, we do not see signs of reversal in the pair.

- Next bull target lies at 214 (261.8% Fibo).

Support levels - 158.12 (5-DMA), 134.26 (161.8% Fib extension of 3.7385 to 84.41 rally), 110.06 (20-DMA)

Resistance levels - 198.47 (241.4% Fib), 214.93 (261.8% Fib)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NEO-USD-breaks-major-trendline-resistance-at-10950-scope-for-test-of-1618-Fib-at-134-1087646) has almost hit all tragets.

Recommendation: Book partial profits at highs, trail stop loss to 150, hold for 200/ 214.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest