The protectionism / de-globalization theme resurfaced overnight, with news that the US administration might sign an executive order to withdrawal from NAFTA.

It is a required element if Trump plans to eventually withdrawal (starts the clock on the 6-month period before withdrawal can occur), but it would not require him to do so. It has also been reported that Trump might sign a letter to Congress to notify lawmakers of the intention to renegotiate the terms of NAFTA.

This dual approach (intent to renegotiate and to withdrawal), provides maximum flexibility and could simply be a negotiating tactic to put pressure on Mexico and Canada. But at this point it is unclear whether the executive order will be signed or whether a more friendly negotiation process will be attempted first.

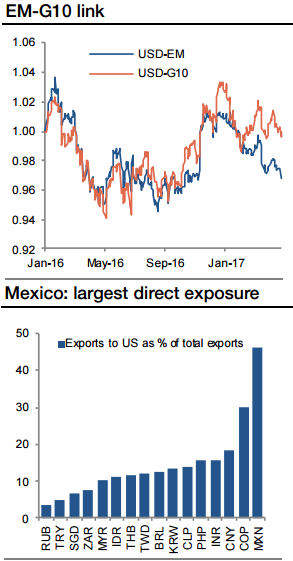

There is a natural speed limit to EM currency appreciation (at least historically) – namely the magnitude of appreciation in G10 currencies.

Small deviations can occur, such as the modest EM spot outperformance since the start of the year (which on a total return basis is amplified by carry), but for EM currency gains to be maintained it will require the dollar weakening against G10 if history is any guide.

Unless the reflation, Trump, protectionism, China growth, or CNY trades resurface with a vengeance, we are happy buying EM FX on sell-offs and sticking with the carry trade. Specifically, we like short SGDINR as a long term trade and short USD against ZAR and MXN over a medium term horizon.

Until there is more clarity on Trump’s decision, ultimate plan, or the evolution of renegotiation, risk premium across EM could remain elevated. The worst case scenario for EMFX would be a hostile approach (notification of intent to withdrawal).

The MXN suffered overnight on the news (as did general EM sentiment), breaking through 19 and the 50d moving average and in recent days posting its worst performance since early January.

This has proved detrimental to the shorts in USD against emerging baskets such as ZAR & MXN trade recommendations, but we are content to hold onto high yielders until there is further clarification on US trade policy.

Despite the weakness in the peso, the Mexican rate curve barely budged with the 2s10s holding near all-time lows. Yesterday we recommended entering steepener positions in Mexico, but if MXN depreciation gathers steam toward 20, the curve could start to invert.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary