EUR-denominated correlations offer better value as shorts than standalone EUR-vols in a benign French election outcome scenario. EURUSD vs. EURCHF correlations are at all-time (Lehman’08) highs and offer deep value from the short side as the franc’s muted participation in a Euro bounce can de-couple EURCHF from higher beta EUR plays.

EUR-correlations a sale on a benign French election outcome EUR-denominated correlations offer better value than outright EUR-/EUR-cross vol shorts for those mulling selling EUR-related option risk premia in the event of a baseline Le Pen/Macron outcome over the weekend.

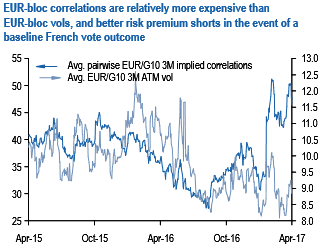

First, EUR-bloc implied corrs screen significantly more expensive compared to EUR-bloc ATM vols, and accordingly have more room to correct than the latter (refer above chart). EUR-based correlations can be thought of as packages of two EUR-cross vols against a third, non-EUR vol. The re-pricing lower in EUR-cross vols witnessed since late February over Le Pen’s inability to close the opinion poll gap to Macron has not entirely been transmitted to EUR correlations, because non-EUR vols, especially those in USD pairs, have collapsed themselves since the dovish March FOMC and partially offset EUR developments.

Second, EUR correlations boast of a better track record as a systematic short than EUR vols, especially during financial market disruptions (refer 2nd chart) which are once again attributable to their being long/short option packages that enjoy some degree of protection from their long vol components. LHS shows stylized returns of selling an equally weighted basket of EUR/G10 3M volatilities (9 straddles) every month, and rolling into fresh 3M shorts at the end of the month. Monthly vol returns calculated simplistically as 3M implied volT – (2/3)*2M implied volT+1M – (1/3)*1-mo realized volT+1M. RHS plots stylized returns of selling an equally weighted basket of EUR/ CCY1 vs. EUR/CCY2 3M correlations within the G10 universe (36 combinations in all) every month, and rolls into fresh 3M shorts at the end of the month. Monthly correlation returns calculated simplistically as 3M implied corrT – (2/3)*2M implied corrT+1M – (1/3)*1-mo realized corrT+1M.

As inviting as the RV set-up is, all of the above can turn out to be academic if option markets are efficient enough to hammer vols and correlations to or below their forward levels in an as-expected election outcome scenario. Hence we refrain from a forensic examination of value within the EUR-correlation universe just yet, and instead, flag EUR correlations as a potential class of alpha generators to keep on the radar should pockets of opportunity still remain next week.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings